Home equity loan balances fall again in Q4'15

SNL Report: Big banks see continuing runoff

- |

- Written by SNL Financial

SNL Financial, part of S&P Global Market Intelligence, is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the subscriber side of SNL Financial's website.

SNL Financial, part of S&P Global Market Intelligence, is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the subscriber side of SNL Financial's website.

By Kate Garber and Venkatesh Iyer, SNL Financial staff writers

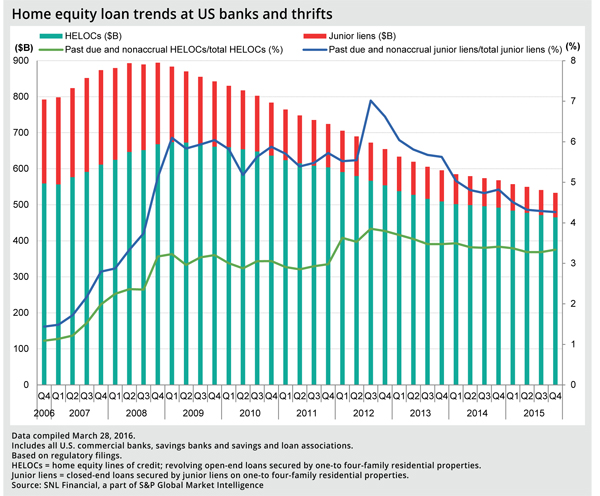

Home equity loans and lines of credit declined on the balance sheets of the nation's largest banks during the fourth quarter of 2015, as pay-downs of equity lines and balances outpaced new originations.

The final three months of 2015 marked the 28th consecutive quarter of declines in home equity loans and lines of credit in the banking industry. The aggregate balance among U.S. banks and thrifts dropped 1.5% to $533.14 billion as of Dec. 31, 2015, according to SNL Financial data.

Slow rise, no frenzy

Although HELOC originations have climbed gradually since 2010, the recent surge in this line of business pales in comparison to the peak level of originations in 2004, according to Daren Blomquist, senior vice-president at RealtyTrac.

"Even though people are regaining equity, you're not seeing as frenzied of behavior as you were 10 years ago where people were leveraging their homes basically like an ATM machine," he added. "Certainly people got burned by doing that last time around. Also, the banks got burned in allowing that behavior to go on."

A rising interest rate environment could also be motivating some borrowers to pay off their HELOCs before their 10-year draw period ends and the loan becomes fully amortizing, Blomquist noted. If interest rates increase, he said the borrower could experience a "double whammy" in terms of payment shock.

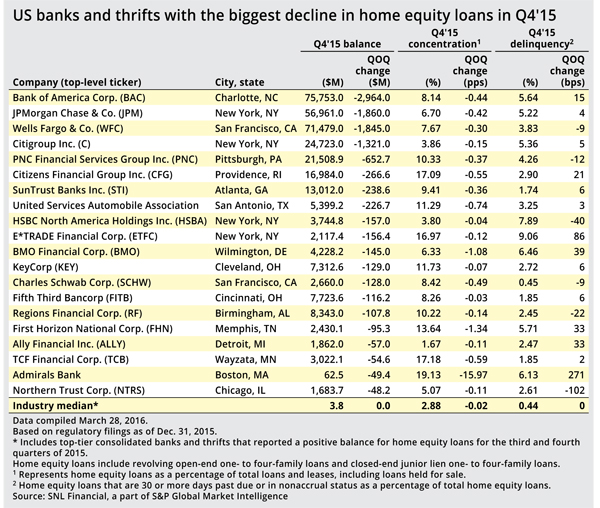

The balance sheet decline was especially pronounced at the “Big Four” U.S. banks.

Wells Fargo & Co.'s home equity loans declined $1.85 billion from the linked quarter—a trend that CFO John Shrewsberry said is likely to continue.

A “going away” business?

"[H]ome equity is sort of a going away business, because we've got a portfolio that's been shrinking for a long time," Shrewsberry said of the bank's home equity line of business during an earnings call in January. "It's been improving in performance, and it just is not being added for a variety of reasons on a net basis. And that's unlikely to change."

Blomquist said the nation's largest banks have the most HELOCs originated during the "bubble era." Companies like Bank of America Corp. have a balance of home equity loans associated with the large number of HELOCs approaching their end-of-draw periods.

Mike Fratantoni, the Mortgage Bankers Association's chief economist, made a similar point. "Large banks had been leading providers of HELOCs pre-crisis, so it is not surprising that they are seeing these trends to an even greater extent," he said in an email.

Some promoting HELOCs again

Despite the relatively cautious approach to HELOCs on the part of both borrowers and lenders, some banks are bolstering their HELOC marketing efforts. For banks looking to lend beyond purchase and refinance products, Blomquist said HELOCs are a relevant product for the growing market of customers with home equity.

Cincinnati-based Fifth Third Bancorp announced a home equity line of credit special on March 31. "That's actually pretty typical, to see spring promotions, but there definitely seems to be an increase in overall marketing activity," said Nancy Elkus, vice-president and senior consumer lending product manager for Fifth Third Bank. "We recognize that there is more opportunity in the market for customers."

This article originally appeared on SNL Financial’s website under the title, "Home equity loan balances fall again in Q4'15"

Tagged under Consumer Credit, Mortgage Credit, Risk Management, Mortgage, Credit Risk, Mortgage/CRE, Residential, Feature, Feature3,