Paperless-only statements could reap huge savings

Bridging digital gap could mean up to $2.2 billion

- |

- Written by Website Staff

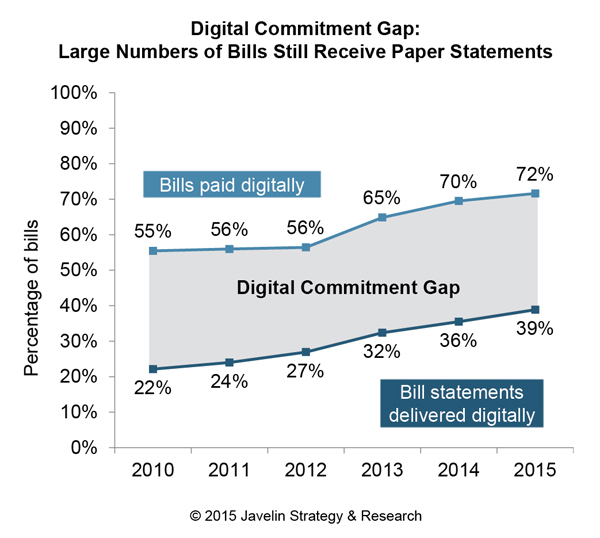

Digital banking may be on its way to being a way of life—72% of bills get paid via online or mobile channels—yet only 39% of statements are delivered digitally, says Javelin Research.

The potential payoff to financial institutions and billers of closing this “digital commitment gap” could amount to $2.2 billion in savings over the next five years, Javelin projects.

The number of consumers who receive both a paper and a digital statement remains steady. Nearly one in four checking account owners and bill payers still receive both, a constant since 2010. Converting double-dippers and paper-only holdouts will not be easy, as financial institutions and billers have already capitalized on the most-willing consumers’ desire to eliminate clutter in their financial record-keeping and help the environment.

“Financial institutions and billers must upgrade the digital experience to satisfy customers who seek a paperless lifestyle—or even just a less-paper lifestyle,” says Ian Benton, research specialist at Javelin. “To achieve greater paper turnoff, financial institutions and billers must think bigger about the overall digital experience, break down organizational silos, and deliver a digital lifestyle that is integrated, complete, and reliable.”

Tagged under Retail Banking, Customers,