Deregistration decision: JOBS Act drives 61 to file goodbye to SEC

- |

- Written by SNL Financial

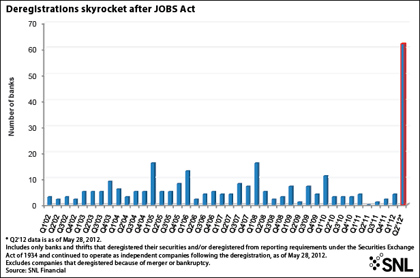

Deregistrations of banking companies have shot up since Congress passed legislation in April, SNL Financial reports. (For a larger version of the chart, click here.)

Has your bank been mulling deregistration from Securities and Exchange Commission reporting in the wake of April’s passage and signing of the Jumpstart Our Business Startups Act--the JOBS Act? If you head for the door, you may find there’s a line.

On May 29 SNL Financial reported that 61 banking companies had filed to deregister their common stock and suspend securities reporting requirements, all since passage of the law.

SNL Financial noted that this is greater than the total of banks that have deregistered in the last 16 quarters. Starting in 2002, after the mid-year enactment of the Sarbanes-Oxley Act, there was a rash of deregistering, or at least much talk about it. But the industry’s latest quarter blows away anything in recent years.

SNL reported that the majority of the filers were under $1 billion in assets, and 49 of the 61 were under $500 million in assets. SNL says that 336 banks and thrifts have less than 1,200 shareholders, which is the new threshold below which a company can deregister.

On May 29 SNL Financial reported that 61 banking companies had filed to deregister their common stock and suspend securities reporting requirements, all since passage of the law.

SNL Financial noted that this is greater than the total of banks that have deregistered in the last 16 quarters. Starting in 2002, after the mid-year enactment of the Sarbanes-Oxley Act, there was a rash of deregistering, or at least much talk about it. But the industry’s latest quarter blows away anything in recent years.

SNL reported that the majority of the filers were under $1 billion in assets, and 49 of the 61 were under $500 million in assets. SNL says that 336 banks and thrifts have less than 1,200 shareholders, which is the new threshold below which a company can deregister.

Stories behind the stats

What are banking companies saying about their decisions to deregister under the JOBS Act? They speak of big cost and time savings, and generally downplay any impact on shareholders.

Here’s a sample of comments from official company press statements released since the JOBS Act was signed, by companies that filed or intend to file to deregister. (Links will take you to the full announcements.)

What are banking companies saying about their decisions to deregister under the JOBS Act? They speak of big cost and time savings, and generally downplay any impact on shareholders.

Here’s a sample of comments from official company press statements released since the JOBS Act was signed, by companies that filed or intend to file to deregister. (Links will take you to the full announcements.)

• Coastal Banking Co., Beaufort, S.C. Paul R. Garrigues, chief financial officer stated that: “The decision to deregister from the SEC was driven by a desire to achieve substantial annual savings by reducing accounting, legal, and administrative costs associated with being an SEC registrant. We expect to achieve an estimated $200,000 in annual cost savings, while maintaining the integrity and liquidity of our investors' stock holdings. Our stock will continue to trade on the Over-the-Counter Bulletin Board and we intend to continue to prepare and publish quarterly and annual financial results via our website, which will be similar in nature to much of the financial information currently disclosed in our periodic SEC reports.” The company also noted that it will be filing financial reports with federal banking regulators.

• Peoples Financial Services Corp., Hallstead, Pa. “Peoples believes that currently the incremental cost of compliance with general SEC regulations and Sarbanes-Oxley and other reporting requirements does not provide a discernible benefit to the Company and its shareholders,” stated Alan Dakey, president and CEO. Annual savings were estimated at $150,000.

• CIB Marine Bancshares, Inc., Waukesha, Wis. In a press release the company stated that the three-state operation would deregister: “The decision of the Company's Board of Directors to deregister came after careful consideration of the advantages and disadvantages of being an SEC registered company, including the disproportionately large costs of preparing and filing periodic reports with the SEC; the substantial audit, legal and other costs and expenses associated with such filings; and the additional demands placed on management and Company personnel to comply with reporting requirements. Both management and the Board of Directors expect the transition to be in the best interest of CIB Marine's shareholders.”

• Citizens Community Bank, South Hill, Va., which has operations in Virginia and North Carolina, issued a statement in which President and CEO Thomas Manson said, “We will realize modest hard dollar cost-savings in reduced legal and audit expenses, filing fees and other, related costs of compliance with the Exchange Act. In addition to the hard dollar cost savings, deregistering our shares will also enable senior management to focus more on the day-to-day management of the bank, as opposed to the considerable time necessary to manage compliance with our reporting requirements. … Both management and the Board of Directors expect this transition to in the best interest for our shareholders.”.

• Highlands State Bancorp, Inc., Vernon, N.J. Mr. George Irwin, president and CEO at this N.J. company, stated that: “Deregistering from the Exchange Act will not affect trading in our common stock. We will remain quoted on the OTC Bulletin Board. However, by deregistering under the Exchange Act, we will realize substantial cost-savings in reduced legal and audit expenses, filing fees and other, related costs of compliance with the Exchange Act.”

[This article was posted on June 1, 2012, on the website of Banking Exchange, www.bankingexchange.com.]

Tagged under Management, Financial Trends, Community Banking,

Related items

- Wall Street Looks at Big Bank Earnings, but Regional Banks Tell the Story

- How Banks Can Unlock Their Full Potential

- JP Morgan Drops Almost 5% After Disappointing Wall Street

- Banks Compromise NetZero Goals with Livestock Financing

- OakNorth’s Pre-Tax Profits Increase by 23% While Expanding Its Offering to The US