Beyond the barrel

SNL Report: Banks in energy states grow loans despite slide in oil prices

- |

- Written by SNL Financial

SNL Financial is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the subscriber side of SNL Financial's website.

SNL Financial is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the subscriber side of SNL Financial's website.

By Kevin Dobbs and Razi Haider, SNL Financial staff writers

Despite recurring headline worries about slumping oil prices and analysts' concerns that the energy downturn could eventually devolve into a broader economic lull in states such as Texas, community bankers continue to expand loan portfolios and are generally upbeat on lending conditions.

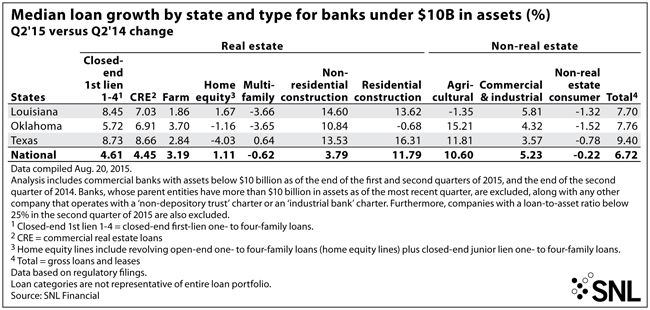

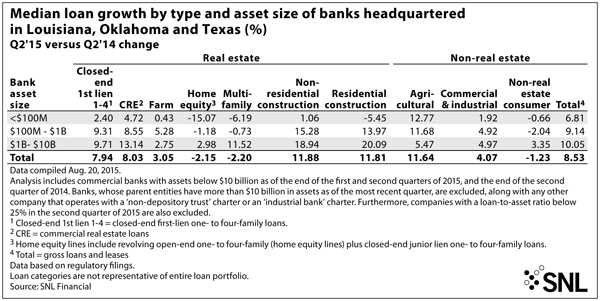

An SNL Financial analysis of regulatory filings found that banks under $10 billion in assets in the energy-driven states of Texas, Oklahoma, and Louisiana collectively grew second-quarter lending from a year earlier more than banks did nationally.

Median loan growth among community banks reached 9.4% in Texas, 7.76% in Oklahoma, and 7.7% in Louisiana, according to the analysis. Median growth nationally was 6.72%.

Commercial-and-industrial lending, which includes a big chunk of credit extended to the oil-and-gas sector, was lighter. But banks in the energy states nevertheless continued to show expansion. Median second-quarter C&I loans grew 3.57% from a year earlier in Texas, 4.32% in Oklahoma and 5.81% in Louisiana. Median C&I loan growth nationally was 5.23%.

Diversity assists lenders

Analysts say C&I lending grew at a slower rate in states such as Texas because of waning loan demand from the energy sector, but they said that, through the first half of this year, economic conditions broadly remained solid enough to continue fueling demand from other areas.

D.A. Davidson & Co. analyst Gary Tenner attributed this to economic diversity, noting that, while bolstered by the oil-and-gas sector in recent years, Texas and neighboring states are substantially more economically diverse today than they were in during the energy doldrums of the 1980s, allowing banks to lend into a range of industries and offset weakness in the energy sector.

McKinney, Texas-based Independent Bank Group Inc., for one, confirmed this during the company's recent second-quarter earnings call. Chairman and CEO David Brooks said that Independent generated annualized loan growth of about 9% in the second quarter. He said while the bank did see a reduction in its energy loan book, it expanded its commercial real estate and non-energy C&I portfolios. He expects further expansion in the second half of this year.

Brooks forecast annualized loan growth for the second half in the "low to mid-teens" and added that Independent has "a great pipeline." He said loan demand is the strongest in Austin. The capital city of Texas is not energy-dependent and, analysts told SNL, is among several markets in that part of the country, including Dallas and San Antonio, that are economically diverse and could continue to be strong sources of loan demand in coming quarters.

Oil still smudges horizon

All of that noted, analysts say, there is increasing reason for concern about banks that are involved in energy lending.

U.S. benchmark West Texas Intermediate crude hovered close to $41 per barrel in mid-August, trading around 6.5-year lows. Oil prices dropped sharply in 2014, but later recovered ground and rallied to around $60 per barrel in June. Since then, however, prices have fallen substantially amid global oversupply and other factors.

If prices remain low or go even lower, more energy borrowers are bound to struggle, resulting not only in diminished loan demand but also deteriorating credit quality. That could drive up credit costs for banks and crimp their bottom lines.

The "recent oil decline only adds to our conviction that additional issues will materialize later this year," Evercore ISI analyst John Pancari said in a recent report.

"For example," Pancari continued, "energy borrowers are increasingly dependent on asset sales to meet [capital expenditure] plans and debt paydowns. Such asset sales could become a greater challenge with the continued slide in oil."

Some analysts are beginning to express concern about banks exposed not only to oil-industry borrowers but generally to local economies that could suffer amid a protracted energy recession.

Tenner told SNL that, back in June, when oil prices were as high as about $60 per barrel, most banks had stress tested their energy books and were confident they could weather the cycle with modest increases to provisions.

Independent, for example, recognizing the energy environment and noting a classified energy loan that was placed on nonaccrual status earlier this year, did bump up its second-quarter loan-loss provision when compared with a year earlier. But executives said they were not overly concerned. "Earnings remain solid and asset quality remains strong, despite the energy market," Brooks said.

But now that oil prices have dipped back down to the $40s, many bankers in Texas and nearby states are likely getting a little more nervous. "Certainly, on a relative basis, they can't be feeling as good now," Tenner said.

He said that, if the oil-price slump extends into 2016, community banks could also start to see general asset quality issues linked to weaker local economies.

Local concentration can be a factor

While the likes of Austin are diverse, many smaller communities that pepper large swaths of Texas and parts of Oklahoma and Louisiana are more dependent on energy. Local businesses need energy-sector employees buying their products and services, so if energy employment levels not only decline but remain low for an extended period, a range of business and consumer borrowers could struggle.

"With oil in the low [$]40s now, if it gets even cheaper, you will see pressure on local economies," Tenner said. "The longer this goes on, the more you will see in terms of secondary impacts."

Brett Rabatin, a Piper Jaffray analyst, agreed. He told SNL that more investors, too, are growing apprehensive about companies active in Texas, in particular.

"There are people who just don't want to talk about Texas because they think it's uninvestable right now," Rabatin said. "They just don't have confidence in where it is headed."

He said most banks in energy-heavy states continue to strike upbeat tones on credit quality and expect only small losses, if any. "But more investors don't believe it," he said.

This article originally appeared on SNL Financial’s website under the title "Banks in energy states grow loans despite slide in oil prices.”