Fundamental shifts seen in POS, digital shopping

Contactless payments to surge, as will mobile ecommerce

- |

- Written by Website Staff

The shift to EMV in the U.S. is happening in parallel with the emergence of mass-market mobile payment initiatives, notably Apple Pay and Android Pay.

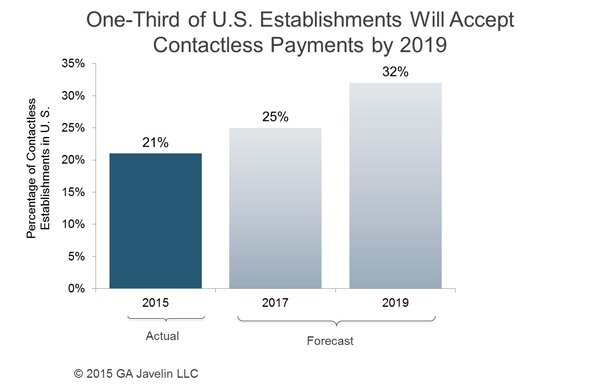

Javelin forecasts nearly a third of U.S. retail establishments will accept contactless EMV card payments by 2019. This estimate stems from the growing case for the introduction of dual interface mobile payments and contactless EMV cards in the second wave of EMV card portfolio replacement to streamline the user payment experience.

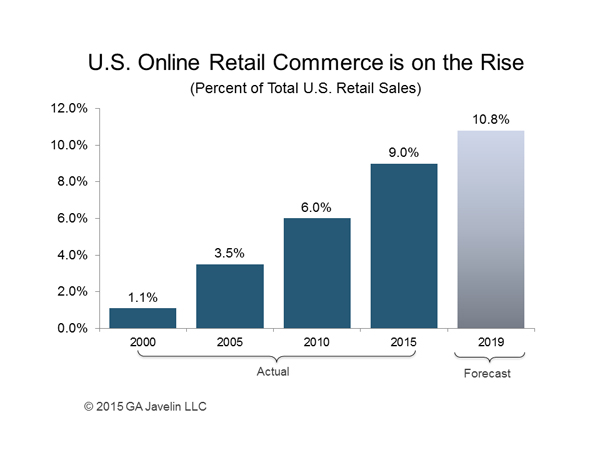

Meanwhile, in a separate report, Javelin says mobile shopping will drive overall ecommerce shopping, Alternative payments options, such as PayPal Credit, will soar with frictionless checkout.

Regarding the POS forecast, “the first wave of EMV card issuance can be categorized as achieving maximum liability shift as quickly and cost effectively as possible within a card portfolio by replacing older mag stripe cards with new EMV contact cards.” says Michael Moeser, director of Payments, Retail and Small Business, at Javelin.

Moeser says that Javelin believes that in the next wave of card issuance, the speed and convenience offered by contactless EMV cards “could be instrumental in gaining top-of-wallet status, as well as attracting and retaining more affluent customers.”

Looking at the equipment side

With the tailwind provided by Apple Pay and Android Pay to motivate merchants to upgrade their point-of-sale terminals for contactless EMV transactions, virtually all EMV terminals manufactured in the past few years come with the hardware for contactless transactions at no extra cost.

On the ecommerce side, mobile is rapidly displacing laptops and desktops. Shopping through mobile devices is forecasted to grow to a 42% share of online commerce by 2019, reaching $218 billion in sales.

Javelin believes that the holiday shopping season will be fueled by mobile shopping. It will also open the door to alternative payment providers who are ready with a frictionless checkout experience.

“Instead of heading to stores for the last-minute gifts, shoppers will pull out their phone on the way to the party and order a last-minute gift,” says Moeser. “Consumers are clearly opting for shopping using the smaller screen while on the go. Single-click transactions are the holy grail of alternative payments providers, as speed of the transaction is one of the top reasons consumers choose an alternative payment options.”

Related items

- Inflation Continues to Grow Impacting All Parts of the Economy

- Banking Exchange Hosts Expert on Lending Regulatory Compliance

- Merger & Acquisition Round Up: MidFirst Bank, Provident

- FinCEN Underestimates Time Required to File Suspicious Activity Report

- Retirement Planning Creates Discord Among Couples