SNL Report: Latest branch office acquisition scorecard

SNL Report: Deals, though active, down by 14%

- |

- Written by SNL Financial

By Tahir Ali, SNL Financial staff writer

New branch openings are on the decline, but some banks continue to expand their branch networks through mergers and acquisitions.

There were 89 deals announced in 2012 involving only bank branches. That is up from 83 in 2011. If all pending branch deals announced in 2012 close, the transactions will result in the transfer of 376 branches, compared to 429 branches transferred in 2011.

Who's shopping hardest

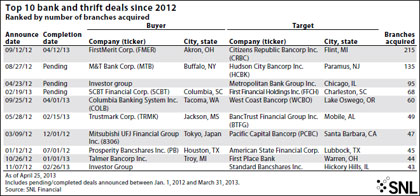

SNL ranked the ten largest branch deals announced since the beginning of 2012. For this analysis, SNL evaluated deals announced between Jan. 1, 2012, and March 31, 2013, in three categories: branch-only deals, whole company deals, and government-assisted deals.

People's United Financial Inc.'s acquisition of 57 branches in the Greater New York metro area from RBS Citizens Financial Group Inc. was the largest branch-only acquisition announced since Jan. 1, 2012. With the majority of the acquired branches located in stores, People's United now ranks sixth among banks and thrifts with the most in-store branch deposits.

Following an agreement with the U.S. Department of Justice, First Niagara Financial Group Inc. completed the sale of 37 branches to KeyCorp and another divestiture of 19 branches to Community Bank System Inc., with the deals ranking second and seventh, respectively, among branch deals announced between 2012 and March 31, 2013.

Bank of America Corp. has announced eight branch deals encompassing 93 locations since the start of 2012, as part of its shrinkage plan.

Most recently, the bank agreed to sell nine branches to First Financial Corp. and 24 branches to Old National Bancorp. Once completed, Old National's deal will tip the bank over the $10 billion asset threshold.

For a larger version of the table, click on the image or click here.

Among all of the 371 whole company, branch, and government-assisted bank and thrift deals announced in 2012, FirstMerit Corp.'s acquisition of Citizens Republic Bancorp Inc. and its 215 branches ranked at top of the charts for total number of branches transferred in 2012. The deal allowed First Merit an entry into the Michigan and Wisconsin markets.

Although M&T Bank Corp.'s plan to acquire Hudson City Bancorp Inc. received shareholders' approval, the deal is facing a delay due to regulatory concerns. If completed, the announced acquisition of 135 branches will rank second place among deals announced since the beginning of 2012.

Mitsubishi UFJ Financial Group Inc., completed the acquisition of Pacific Capital Bancorp in 2012, adding 47 branches to its network along with $4.7 billion in deposits, as of Sept. 30, 2012. The Japanese megabank has shown keen interest in the U.S., as it strives toward expanding its overseas revenue contribution to 40% by March 2015.

For a larger version of the table, click on the image or click here.

Government deals down

There were 47 government-assisted deals for 186 branches in 2012, down from 90 deals for 626 branches in 2011.

The acquisition of Citizens First National Bank and its 21 branches by Heartland Bancorp Inc. remains at the top of the government-assisted branch M&A chart in 2012. At the time of its failure, Citizens First National was expected to cost the FDIC's deposit insurance fund $259.6 million.

For a larger version of the table, click on the image or click here.

So far, a total of eight government-assisted deals have closed in 2013. Heritage Financial Group Inc.'s March 8 purchase of Frontier Bank remains at the top of the branch transfer rankings for 2013, with 10 branches.

Tagged under Financial Trends,