SNL Report: CRE growth tops at $10-$15 bil. banks

SNL Report: 4th quarter saw drop in building & land development credit

- |

- Written by SNL Financial

By Harish Mali and Robert Clark, SNL Financial staff writers

Total CRE loans at commercial banks grew by $9.09 billion, or 0.94%, during the fourth quarter of 2012, amounting to $971.27 billion at Dec. 31, 2012. All of the components of CRE loans, except construction and land development loans, had positive growth during the quarter. Loans not secured by real estate and multifamily loans grew by 3.35% and 2.83%, respectively, during the quarter, whereas the construction and land development segment continued to skid, down by 3.22%.

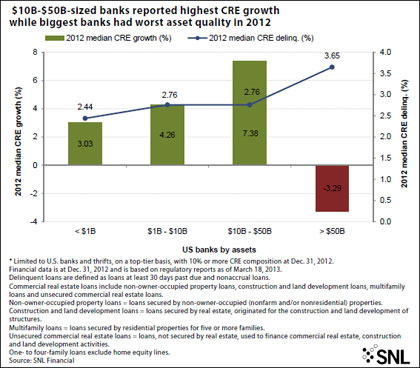

SNL studied CRE trends at top-tier banks and thrifts of varying asset size and found that companies with $10 billion to $50 billion recorded the highest median loan growth of 7.38% during 2012. That category had a median delinquency rate of 2.76%. Companies with greater than $50 billion of assets saw a median decline of 3.29% in their CRE portfolio. These big banks also had the highest median delinquency rate of 3.65%.

For a larger version of the bar chart, click on the image or click here.

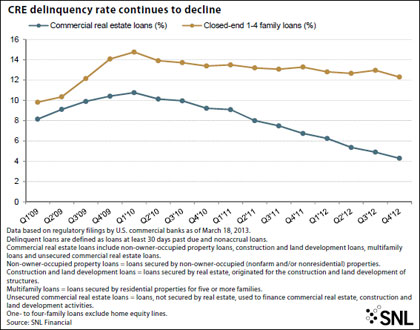

Commercial real estate asset quality at U.S. commercial banks continues to heal, as the aggregate delinquency rate is at the lowest level in the last 16 quarters. The CRE delinquency rate stood at 4.29% at the end of 2012, significantly down relative to a recent peak of 10.76% at March 31, 2010, and the lowest level since 3.1% at the end of 2007.

As a point of comparison, the pace of recovery has been less than stellar for closed-end one-to-four-family loans. The aggregate delinquency rate on such loans remains in double digits at 12.30%, down 245 basis points from the recent quarterly peak at March 31, 2010.

For a larger version of the chart, click on the image or click here.

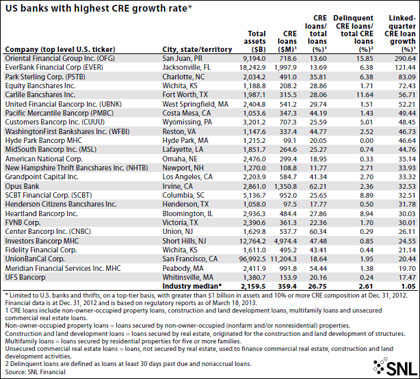

SNL also created a list of CRE lenders with the highest growth rate in the fourth quarter of 2012. Banks and thrifts with less than $1 billion in total assets and 10% CRE composition were excluded from the analysis.

San Juan, Puerto Rico-based Oriental Financial Group Inc. topped the list, nearly tripling its CRE portfolio during the 2012 fourth quarter. Most of that growth came from non-owner-occupied CRE, acquired from Banco Bilbao Vizcaya Argentaria SA. During the quarter, Oriental Financial bought BBVA's Puerto Rico operations in a deal valued at $500 million. The delinquency rate of Oriental Financial's CRE portfolio was 15.85% as of Dec. 31, 2012, the highest among all companies on the list.

Jacksonville, Fla.-based EverBank Financial Corp. was the other company to more than double its CRE portfolio in the quarter ended Dec. 31, 2012. Like Oriental Financial, the non-owner-occupied category represented most of the CRE portfolio and the growth was fueled by a significant deal. EverBank completed an acquisition of Business Property Lending Inc. from General Electric Capital Corp. in October 2012.

For a larger version of the table, click on the image or click here.

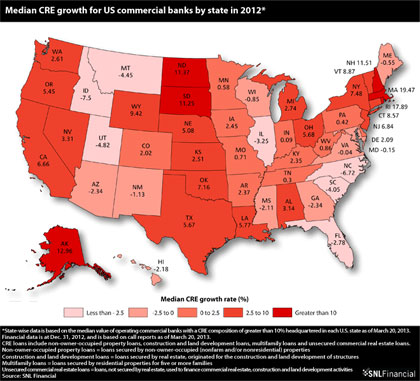

SNL analyzed the 2012 median CRE growth rate for U.S. states based on all commercial banks with a CRE composition greater than 10% that were based in each state. More than two-thirds of the 50 states saw an increase in CRE loans during 2012. In fact, there were six states with a double-digit growth rate. Massachusetts recorded the most growth, with a rate of 19.47%, followed by Rhode Island and Alaska at 17.89% and 12.96%, respectively. New Hampshire and the Dakotas are the other three states with growth in excess of 10%.

Sixteen states saw a decline in their CRE portfolio during the year ended Dec. 31, 2012. Idaho and North Carolina witnessed the most attrition, with respective median declines of 7.50% and 6.72% in their CRE lending during the year.

For a larger version of the map, click on the image or click here.

[This article was posted on March 27, 2013, on the website of Banking Exchange, www.bankingexchange.com, and is copyright 2013 by the American Bankers Association.]

Tagged under Management, Financial Trends,

Related items

- How Banks Can Unlock Their Full Potential

- JP Morgan Drops Almost 5% After Disappointing Wall Street

- Banks Compromise NetZero Goals with Livestock Financing

- OakNorth’s Pre-Tax Profits Increase by 23% While Expanding Its Offering to The US

- Unlocking Digital Excellence: Lessons for Banking from eCommerce Titans