Get the customer, get the business

Millennials leading banking disruption

- |

- Written by Website Staff

Today's consumers want control over their finances, delivered in the form of effortless, instant interactions that don’t interrupt their lives, according to Fiserv’s 13th annual consumer trends survey.

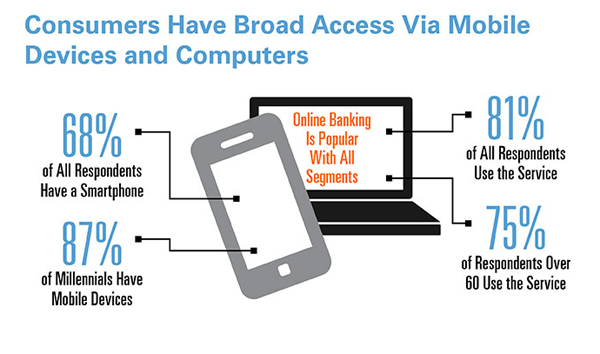

Modern consumers are socially connected and unceasingly attached to their mobile devices, too, according to the survey. In this environment, financial institutions that understand their needs and remain focused on enabling the control, convenience, and speed that consumers demand are those that will succeed.

Conducted regularly since 2002, the company’s survey shows dramatic changes in online, mobile, and tablet banking since it began. Using a smartphone to manage one’s account or pay one’s bills wasn't an option just ten years ago. Now, 35 million households bank from their mobile phones.

While new services such as tablet banking and person-to-person payments have emerged, existing services such as online banking and bill payment have seen phenomenal growth. One capability that was available at the start of the survey—online banking—has experienced an 83% adoption increase in the last ten years.

The survey shows steady increases in digital banking—mobile adoption increased 17% between 2013 and 2014. Not surprisingly, increases in smartphone ownership are driving increases in mobile banking usage, with 48% of smartphone-owning households using mobile banking in the month prior to the survey.

Interest in digital banking and payments services among nonusers is also up. Between 2013 and 2014, interest in financial institution billpay increased from 21% to 33%, while those interested in receiving e-bills grew 30%. Nearly a quarter of nonusers are interested in using person-to-person payments.

Taken together, the increased interest in digital financial services presents a wide range of opportunities for financial institutions to deepen relationships with their customers. In this dynamic market, it's up to financial institutions to provide the capabilities people want, educate consumers about them, and market available services and their benefits—actions that will position the financial institution at the center of their consumers' financial lives.

"Expect equally dramatic changes in the next decade, as wearable technology and mobile capabilities continue to expand—with the millennial generation influencing most of these changes," says Roger Johnston, market research director, Fiserv.

Tagged under Retail Banking, Customers, Feature, Feature3,

Related items

- Banking Exchange Hosts Expert on Lending Regulatory Compliance

- Merger & Acquisition Round Up: MidFirst Bank, Provident

- FinCEN Underestimates Time Required to File Suspicious Activity Report

- Retirement Planning Creates Discord Among Couples

- Wall Street Looks at Big Bank Earnings, but Regional Banks Tell the Story