Rising tablet use to precede rebuilt branches

Devices would supplement, replace desktops

- |

- Written by Website Staff

Long before most banks launch new branch designs, tablets will be commonplace in legacy branches in an effort to improve customer engagement, concludes a recent report by Celent.

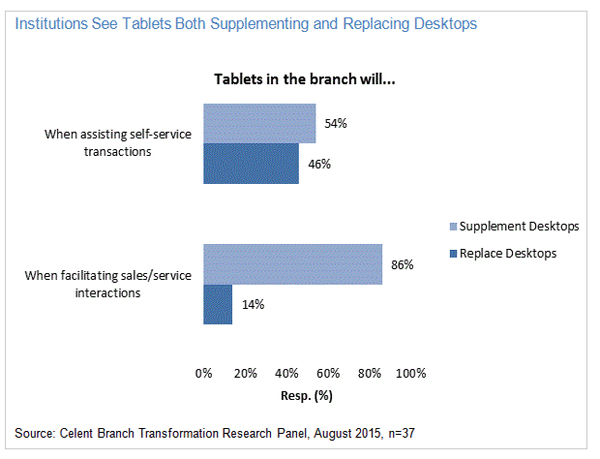

A June 2015 survey found that over 60% of institutions felt that tablet usage by front-line branch personnel would be “extremely likely.” A follow-on survey in August found that institutions are planning to both supplement and replace desktops. Tablets will soon be used to facilitate sales and service interactions as well as to assist self-service transactions.

“Tablets will quickly become a common fixture in the branch,” says Bob Meara, a senior analyst with Celent’s Banking practice and coauthor of the report. “But, with most software platforms not yet tablet-ready, usage will initially be limited to simple tasks.”

Additional insights from the research:

• Banks are focused on a trio of synergistic, short-term branch channel objectives: sales effectiveness, cost reduction, and digital channel adoption.

Digital channel adoption is viewed both as a cost-reduction play and as a more important strategic imperative to ensure customers “see what the bank has to offer.”

• Integrating physical and digital channels is a high short-term priority, with obtaining a “single version of truth” (the proverbial 360-degree customer view) as well as coordinating account and loan origination activities across channels the most pressing objectives.

Digital appointment booking is an important short-term capability for larger banks, with a third rating it “extremely important.” More esoteric examples of digital channel integration such as geolocation and pre-staging transactions are seen as comparatively unimportant.

• Branch software environments are slowly changing.

Emerging environments will leverage middleware and rely on browser-based user interfaces to accommodate a growing number of branch-based devices. Evolution to an omnichannel platform will be far off for most institutions.

Tagged under Management, Retail Banking, Technology, Channels, Feature, Feature3,