Handling changing nature of checking

Looking at intended and unintended consequences of trends

- |

- Written by Mike Moebs

- |

- Comments: DISQUS_COMMENTS

In the final part of a three-part series, “Prairie Economist” Mike Moebs discusses how banks can respond to the changing landscape for checking.

In the final part of a three-part series, “Prairie Economist” Mike Moebs discusses how banks can respond to the changing landscape for checking.

We’ve been discussing the impact of changing attitudes on checking and evolution in the competitive landscape. Let’s now combine these seemingly different checking macro trends showing checking as an economic barometer, along with micro trends of the falling number of checking accounts with rising checking balances. This blending of macro and micro checking trends will then show actions financial institutions can take.

To reiterate something from Part 1: You may be reading elsewhere about high consumer confidence. I say don’t buy into that. The checking barometer is saying this: American consumers are very unsure of their financial future. In uncertainty a person will retain and hold money until the future becomes clearer—this is why checking balances are rising. Yet, consumers and businesses while waiting for a more stable future will seek a less costly checking account.

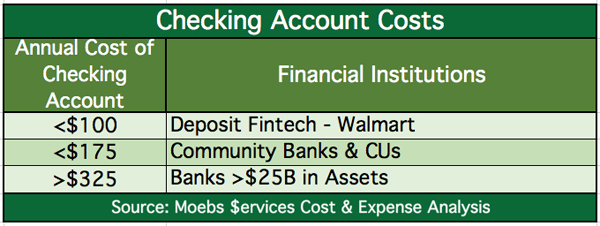

The cost shown in the table above is the yearly cost incurred by each financial institution provider of checking. The lowest annual cost of checking is with “deposit fintech” firms like Walmart. There are two reasons checking is more efficient for Walmart and others: operating cost and IT cost.

Walmart has a vast footprint of stores, so separate branches are not needed. The transaction business of checking requires a physical presence since cash is a dominant element of checking transactions. This is rapidly changing to more digital transactions. Compared to traditional banks deposit fintech firms like Walmart operate the most current, efficient IT systems, and at a much lower cost.

Community banks and credit unions have the next lowest yearly cost of checking. These community financial institutions have lower checking operating cost by reducing staff as much as possible. They provide a less than satisfactory legacy IT system to the consumer, but counter this with low transaction fees and free checking.

Finally, the large banks have very high checking cost. The large banks have too many branches with too many employees. The large banks have inefficient legacy DDA systems, yet they try to make up for this with superior technology in mobile banking and online banking for cutting-edge user experience. To offset these increased costs the large banks have high checking transaction fees and do not offer free checking. A single-service household with checking needs to have high deposit balances or buy other services at a large bank. If balances or more services are not provided, the bank lets the checking user go for lack of profitability. Cross-selling one or more services becomes vital to the large bank’s checking business.

Depositories need to stop the outflow of the checking account transaction users who keep no balance and focus on reducing operational cost and installing lower fees to make checking profitable. Otherwise, the likes of Walmart and its allies and soon Amazon will come to dominate the checking account business. By the time banks feel the real pain of such competition, the battle may be over.

Examining consumer thinking

Here is an overall summary of the macroeconomic and microeconomic factors on consumer checking:

1. The average consumer’s uncertainty makes for hoarding money in checking. This uncertainty is caused by lack of wage growth; jobs in many markets are still hard to find; full unemployment (U6) is high at 7.4%. (U3 is the official unemployment rate, but that is not the whole picture. U5, for example, adds in “discouraged” workers and all other marginally attached labor. U6 adds on those workers who are part-time purely for economic reasons.)

2. With fiscal stimulus coming from tax reform, the consumer is slowly waking like a sleeping giant to stimulate economic growth.

Any fiscal stimulus from Congress takes 6 to 12 months to fully take effect. While consumers are experiencing bigger net pay already, they want to wait to make sure the financial benefit is reality.

3. Less free checking offered, especially by the large banks.

4. Having higher balances in their checking reduces the cost of checking—fewer overdraft fees.

This suggests that banks work to convince customers to consolidate their transaction accounts in one institution.

What should depositories do with checking?

Taking into consideration the macro and micro checking trends with both intended and unintended consequences, banks, thrifts, and credit unions can position their checking portfolios for profitability by:

1. Reducing the number of checking types to no more than three options.

Less is more especially for operational costs, plus front-line personnel can sell more easily when there are fewer options.

2. Reducing consumer checking fees.

Again, less is more. Lower fees will stimulate more usage, or volume, and the loss of price will easily be made up in volume, especially for overdrafts.

This is traditional economics. More people take trains, ferries, and buses when the fare is cut by a third. The fare cut is made up for by increased usage. In much the same way, this will be seen in checking usage.

3. Decide if you want to deal with the consumer who has low balances and lots of transactions.

If yes, then offer free checking.

If you don’t, then stick to your current plan. But know that you will see more migration to competition like Green Dot/Walmart.

4. Understand your checking cost numbers ASAP to help you decide this strategic direction of checking.

To do this properly, you will need to get over some common hurdles. These include:

a. Checking is by far the most difficult service to cost-account.

The reason functional cost of checking is difficult is the complexity of the service and volume. A seemingly simple ancillary service such as a debit card is very complex to track and measure; and the massive amount of volume produced by checking on a daily, monthly, quarterly, and annual basis is by definition Big Data. Get someone who knows costing for checking and have them direct you while you do the work.

b. Proper transfer pricing of the checking portfolio is essential.

Do not treat checking operations and the checking portfolio as a cost center. Make checking a profit center.

5. Training to sell a checking account needs to be at the core of every employee’s job in a financial institution, from the Chairman of the Board and CEO to tellers.

Every financial service employee even in IT, finance, human resources, etc. needs to know how to sell their depository’s checking account.

6. Make your consumer checking portfolio profitable whether stand-a-lone or relationship or both.

The chief thing here is understand your market and develop the appropriate pricing strategy for your checking service. Note I say service and not product.

There are huge differences between services and products. Financial service is the sale of a service.

Key differences: Service is not tangible. Service is ongoing, not a one-time transaction.

So, the key is sell a service and not a product. Carry around soap bars to wash the mouth of the financial institution employee who uses the word product!

We are an army of financial institution service sellers, not a retail store like Walmart, and this attitude and disposition will defeat the Walmarts, fintechs, and other interlopers.

Semper,

Mike Moebs

(Mike will respond to questions at [email protected])

Tagged under Management, Lines of Business, Retail Banking, Blogs, Customers, The Prairie Economist,