Your bank’s secret tech armor

Protect your bank—use competitive bidding!

- |

- Written by Dan Fisher

- |

- Comments: DISQUS_COMMENTS

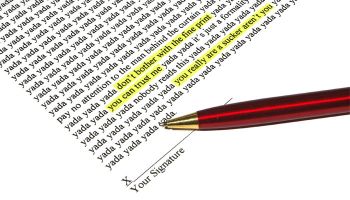

Let the buyer beware!

We have all heard this phrase before, perhaps even in Latin: “Caveat emptor!”

Most of us apply it to individual purchases, but it also applies to your financial institution, too!

Not doing your homework can cost your financial institution. The expense will not only be in missed opportunities, but if you sign the wrong contract, the additional cost could mean hundreds of thousands of dollars.

The greatest risk comes with not competitively bidding large purchases.

As a rule, a large purchase is defined as $25,000 or greater, or a contract or lease with a term of more than one year.

A secondary risk can be a long-term relationship with an existing vendor where at contract renewal time, your automatically renew the contract or just look at their products.

Warning signs to the competitive bid process

To put things into perspective, at the end of the day, the vendor works for the vendor—not you.

They will never tell your institution how to negotiate a better deal or what to ask for.

Furthermore, when a proposal is presented, they will always tell you that this is their best offer. But you have nothing to compare it to. How do you really know?

To top this off, some relationship managers will ask you not to competitively bid—they promise that they can bring in a better offer. Some vendors will ask the client not to use a consultant.

During the last year our clients have come to us with these issues and more. Your immediate response should be to ask yourself and the vendor, “Why?”

What is it that they don’t want you know?

Yes, the competition is stiff right now and that is good for your institution if you exercise the appropriate due diligence in vendor relationships and large purchases. It is in your best interest to be fully informed when making significant purchases.

Using a competitive bid approach is your first line of defense as it relates to cost control, profitability, and implementing products and services that are up-to-date in feature and function. Skepticism is healthy and in your best interests.

But there’s more to this challenge.

Framework for success

1. Don’t wait until the contract expiration to start the competitive bid process.

Plan ahead and be prepared.

2. Notify your current vendor early.

Keep them in the loop. Vendors hate surprises.

3. Create a Request for Proposal.

This does not have to be complicated. But is should clearly define your expectations and cost structure.

4. Don’t get locked in!

Stay away from contracts that contain automatic price increases.

5. Don’t get locked in on time, either.

Stay away from long-term agreements.

Who has more experience?

Finally, remember this: Vendors negotiate contracts and agreements every day.

You organization negotiates contracts and agreements once during the term of the agreement.

Vendors are skilled at this process. More importantly, having an up-to-date market comparison of pricing, services and products is information some vendors just do not want you to have.

Information is your greatest asset when negotiating significant vendor agreements … protect it!

The Wombat!

Tagged under Technology, Blogs, Beyond the Bank, Operational Risk, Feature, Feature3,

Related items

- Banking Exchange Hosts Expert on Lending Regulatory Compliance

- Merger & Acquisition Round Up: MidFirst Bank, Provident

- FinCEN Underestimates Time Required to File Suspicious Activity Report

- Retirement Planning Creates Discord Among Couples

- Wall Street Looks at Big Bank Earnings, but Regional Banks Tell the Story