SNL Report: Top 50 U.S. banks & thrifts by assets

SNL Report: Rankings revised by third quarter business shifts

- |

- Written by SNL Financial

By Aarti Kanjani, SNL Financial staff writer

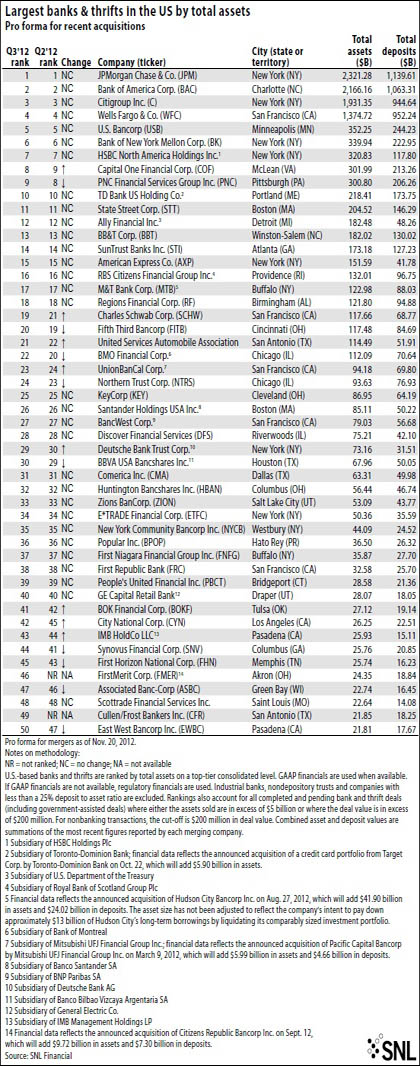

There was little movement in SNL Financial's most recent ranking of the largest 50 banks and thrifts in the U.S. During the third quarter, the only change in the top 18, compared to the second-quarter rankings, was Capital One Financial Corp. and PNC Financial Services Group Inc. switching positions, with Capital One overtaking PNC Financial for eighth place.

SNL's ranking by assets is pro forma for pending M&A deals and transactions that have closed since Sept. 30.

For a larger version of this exhibit, please click on the image or click here.

With the announced acquisition of Citizens Republic Bancorp Inc. on Sept. 12, Akron, Ohio-based FirstMerit Corp. entered the rankings at No. 46, based on Citizens Republic's $9.72 billion in assets and FirstMerit's $14.63 billion in assets, as of Sept. 30.

Toronto-Dominion Bank's Oct. 22 announcement to acquire a credit card portfolio from Target Corp., did not give any boost to the rankings of TD Bank US Holding Co., its U.S. subsidiary. TD Bank clung to the tenth spot, same as the second quarter, based on the summation of its $212.51 billion in assets and Target's $5.90 billion in receivables.

M&T Bank Corp., which rose to the seventeenth spot in the second quarter with its announced $3.81 billion acquisition of Hudson City Bancorp Inc. on Aug. 27, remained at the same position in the third quarter. M&T's new ranking is based on a combination of its $81.09 billion in assets and Hudson City's $41.90 billion in assets, as of Sept. 30. The asset size has not been adjusted to reflect M&T Bank's intent to pay down approximately $13 billion of Hudson City's long-term borrowings by liquidating the comparably sized investment portfolio.

Major movement up, major movements down

The largest jump in the top 50 was seen by City National Corp., which sprang up three spots to No. 42 from No. 45. Its assets rose to $26.25 billion from $24.80 billion in the second quarter. The second-largest upward change in rank belonged to Charles Schwab Corp., moving up two spots to No. 19 from No. 21, as assets jumped to $117.66 billion from $111.82 billion.

The biggest downward movements were Synovus Financial Corp. dropping to No. 44 from No. 41, with assets falling to $25.76 billion from $26.29 billion, and East West Bancorp Inc., falling to No. 50 from No. 47, even after its asset size modestly increased to $21.81 billion from $21.53 billion.

Mitsubishi UFJ Financial Group Inc. announced March 9 that it would acquire Pacific Capital Bancorp from an investor group led by Gerald Ford. UnionBanCal Corp.'s financials are a combination of its $88.19 billion in assets and Pacific Capital's $5.99 billion in assets as of Sept. 30. UnionBanCal jumped to No. 23 from No. 24 in the prior quarter.

One joins, one leaves

Entering at No. 49, Cullen/Frost Bankers Inc. is a newcomer to the list as its asset size increased to $21.85 billion in the third quarter from $20.87 billion in the second quarter.

SVB Financial Group and First Citizens BancShares Inc. fell short and were dropped from the top 50 list. First Citizens' assets fell slightly to $21.17 billion from $21.24 billion in the second quarter, while SVB Financial's assets rose to $21.58 billion from $21.29 billion in the second quarter.

JPMorgan Chase & Co. and Bank of America Corp. remained the only companies with more than $2 trillion in assets and more than $1 trillion in deposits.

SNL excludes holding companies with deposits totaling less than 25% of assets from the ranking, which means that some large firms regulated as bank holding companies, such as MetLife Inc., Goldman Sachs Group Inc., and Morgan Stanley, are not ranked.

-->By Aarti Kanjani, SNL Financial staff writer

There was little movement in SNL Financial's most recent ranking of the largest 50 banks and thrifts in the U.S. During the third quarter, the only change in the top 18, compared to the second-quarter rankings, was Capital One Financial Corp. and PNC Financial Services Group Inc. switching positions, with Capital One overtaking PNC Financial for eighth place.

SNL's ranking by assets is pro forma for pending M&A deals and transactions that have closed since Sept. 30.

For a larger version of this exhibit, please click on the image or click here.

With the announced acquisition of Citizens Republic Bancorp Inc. on Sept. 12, Akron, Ohio-based FirstMerit Corp. entered the rankings at No. 46, based on Citizens Republic's $9.72 billion in assets and FirstMerit's $14.63 billion in assets, as of Sept. 30.

Toronto-Dominion Bank's Oct. 22 announcement to acquire a credit card portfolio from Target Corp., did not give any boost to the rankings of TD Bank US Holding Co., its U.S. subsidiary. TD Bank clung to the tenth spot, same as the second quarter, based on the summation of its $212.51 billion in assets and Target's $5.90 billion in receivables.

M&T Bank Corp., which rose to the seventeenth spot in the second quarter with its announced $3.81 billion acquisition of Hudson City Bancorp Inc. on Aug. 27, remained at the same position in the third quarter. M&T's new ranking is based on a combination of its $81.09 billion in assets and Hudson City's $41.90 billion in assets, as of Sept. 30. The asset size has not been adjusted to reflect M&T Bank's intent to pay down approximately $13 billion of Hudson City's long-term borrowings by liquidating the comparably sized investment portfolio.

Major movement up, major movements down

The largest jump in the top 50 was seen by City National Corp., which sprang up three spots to No. 42 from No. 45. Its assets rose to $26.25 billion from $24.80 billion in the second quarter. The second-largest upward change in rank belonged to Charles Schwab Corp., moving up two spots to No. 19 from No. 21, as assets jumped to $117.66 billion from $111.82 billion.

The biggest downward movements were Synovus Financial Corp. dropping to No. 44 from No. 41, with assets falling to $25.76 billion from $26.29 billion, and East West Bancorp Inc., falling to No. 50 from No. 47, even after its asset size modestly increased to $21.81 billion from $21.53 billion.

Mitsubishi UFJ Financial Group Inc. announced March 9 that it would acquire Pacific Capital Bancorp from an investor group led by Gerald Ford. UnionBanCal Corp.'s financials are a combination of its $88.19 billion in assets and Pacific Capital's $5.99 billion in assets as of Sept. 30. UnionBanCal jumped to No. 23 from No. 24 in the prior quarter.

One joins, one leaves

Entering at No. 49, Cullen/Frost Bankers Inc. is a newcomer to the list as its asset size increased to $21.85 billion in the third quarter from $20.87 billion in the second quarter.

SVB Financial Group and First Citizens BancShares Inc. fell short and were dropped from the top 50 list. First Citizens' assets fell slightly to $21.17 billion from $21.24 billion in the second quarter, while SVB Financial's assets rose to $21.58 billion from $21.29 billion in the second quarter.

JPMorgan Chase & Co. and Bank of America Corp. remained the only companies with more than $2 trillion in assets and more than $1 trillion in deposits.

SNL excludes holding companies with deposits totaling less than 25% of assets from the ranking, which means that some large firms regulated as bank holding companies, such as MetLife Inc., Goldman Sachs Group Inc., and Morgan Stanley, are not ranked.

Tagged under Financial Trends,