Branch closures hit suburbs hardest

SNL Report: Opportunity for smaller banks?

- |

- Written by SNL Financial

By Tahir Ali and Zach Fox, SNL Financial staff writers

As banks close branches in the face of secular pressures, they often point to redundant nearby branches that will continue to serve the community. However, net branch closures since 2010 appear to be more concentrated in the spread-out suburban areas.

Two takes on “the Chicago way”

Bank of America Corp. has openly acknowledged it will favor retention of urban branches while closing others in more rural locations. To test whether industry peers seem to be following the trend, SNL took a look at the largest U.S. metropolitan areas across the country, finding that branch closures have been more likely to hit suburban communities.

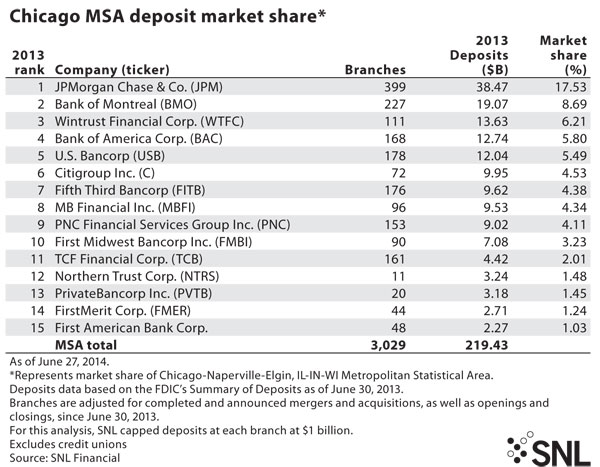

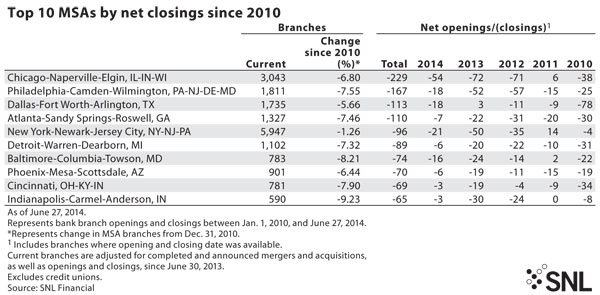

The metropolitan statistical area to see the most net branch closures since 2010 is the Chicago-Naperville-Elgin, IL-IN-WI, MSA.

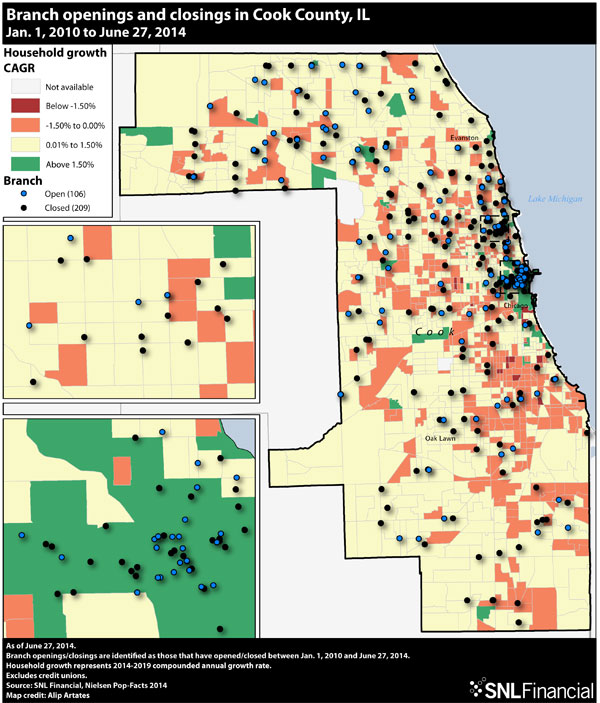

Closures in the metro were more likely to occur on the suburban outskirts. In fact, while the metro area overall led the nation in net branch closures, some neighborhoods in the urban core saw net gains in branches, particularly the area often referred to as the Loop, sandwiched between I-90 and Lake Michigan.

TCF Financial Corp. helped push the Chicago metro area to the top of the net closures list when the bank announced in December 2013 that it would close 37 bank branches located inside Jewel-Osco grocery stores. The move follows an industrywide trend of banks slashing locations, including in-store branches as well as the overall branch footprint.

For a larger version, click on the image.

For a larger version, click on the image.

Mark Goldman, a TCF spokesman, told SNL that the bank is not pursuing an urbanization strategy similar to Bank of America's. Also, Goldman said the bank is deeply committed to the Chicago market, noting "tremendous growth," and that he could not offer specifics on how the bank decided which branches to close.

"We concluded that even with additional products and services, the branches we closed were not going to provide TCF with a reasonable rate of return. And the vast majority of them had another TCF branch very close by, geographically," Goldman said.

When broken down by Census tracts, one tract in that downtown core stood out with 13 branch openings and eight closings. That meant the tract saw five branches open, on net, the largest in the metro area and only one of two tracts to add more than one branch since 2010. Plotting the openings and closings on a map of Cook County, which contains virtually all of Chicago city proper, shows the banking industry's preference for branches in the Loop.

Similarly, bank closures tended to occur at a more rapid clip in the suburban counties outside of the city but included in the MSA definition. Perhaps the most marked example is Kendall County, Ill., which boasts a median income of $81,534, nearly $30,000 over the national median, per Nielsen Pop-Fact. Despite those high incomes, the county lost a larger share of its branches than the Chicago metro area overall.

For a larger version, click on the image.

For a larger version, click on the image.

“Make mine metro”

To a large degree, the suburban focus on branch closures simply follows the broader trend of the strongest population growth occurring in urban cores.

"We've been becoming an increasingly urbanized society for more than 100 years now, and that means that that's where the branch deployment should follow as well," Steven Reider, president of Bancography, a banking consultancy group. "Add to that that there is a significant synergistic benefit in banking in having your branches closely clustered together, and it makes far more sense to pick a limited number of markets to pursue with dense branch deployments than a broad number of markets to pursue with scattered deployments."

A look at the other metro areas with the most net closures and most net openings also supports the trend that bank branch closures are more heavily concentrated in suburban areas, as well as areas potentially prime for consolidation. Generally, Illinois banks are prime for consolidation, as there are a number of smaller players in need of a capital injection and larger, well-capitalized banks hungry for market share.

And Atlanta-Sandy Springs-Roswell, GA, MSA, a metro area notoriously overbanked and well-known for its suburban sprawl, comes in at No. 4 on the list of top net closings by pure volume.

Some metros continue to gain branches

At the other end of the spectrum, California cities led the list of metros to see the largest gains in branches.

By sheer volume, the Los Angeles-Long Beach-Anaheim, CA, MSA, led the way with 33 net branches added since 2010, followed by the San Jose-Sunnyvale-Santa Clara, CA, MSA, with 13 net branches added.

However, underscoring the urbanization trend, while San Jose, San Francisco, and Los Angeles all posted net gains in branches, their exurban bedroom communities—Stockton-Lodi in the north and Riverside-San Bernardino-Ontario in the south—posted net closures of bank branches.

Los Angeles and Chicago represent the nation's second- and third-largest metro areas, respectively. A look at the largest U.S. metro, the New York-Newark-Jersey City, NY-NJ-PA, MSA, also reveals a tendency for bank branch closures to favor suburban communities over a downtown area.

Since 2010, the New York metro area has seen a net loss of 96 branches. However, the five boroughs that constitute New York City proper—Manhattan, Bronx, Brooklyn, Queens, and Staten Island—actually saw a net increase of 31 branches while the suburban counties, such as those in Long Island and Northern New Jersey, combined to see a net loss of 127 branches.

Factors behind strategies

While banks appear to favor communities with higher population density, it should be noted that demographics alone do not explain why banks are closing more branches in certain cities.

For example, the Dallas-Fort Worth-Arlington, TX, MSA, checked in at No. 3 among metro areas with the most net branch closures since 2010. Per SNL's Nielsen demographic data, the Dallas metro area is expected to see its population grow 8.57% through 2019, and the median household income for the area is $56,739. By contrast, the Atlanta metro area, which came in a slot behind Dallas, has a population growth estimate of 6.36% and a median household income of $52,533. Of course, it is important to note that Atlanta is seeing a larger net closure, as a portion of its overall branch footprint.

Still, Detroit is lower on the list than Atlanta, both in absolute and relative terms, and is expected to see a net decline in its population, compared to Atlanta's projected growth.

Banks typically make branch closure decisions based on internal data and the bank's internal strategic initiatives, which make it hard for outsiders to discern the reasoning for any particular branch closure, said Steven Ramirez, CEO of Beyond the Arc, a consulting firm that works with financial institutions.

Further, Ramirez said that as technology becomes more popular for everyday banking needs, financial institutions need to be aware of not just how many people are in an area, but also how those people want to access banking services.

"There may be areas where the demographics are strong, but it doesn't reflect how people are actually choosing to interact with the bank," Ramirez told SNL. "So you might have the right population, but if that population doesn't use the branch as a primary way of managing the relationship, if they're using mobile and online, then you're not going to see growth."

Related items

- Banking Exchange Hosts Expert on Lending Regulatory Compliance

- Merger & Acquisition Round Up: MidFirst Bank, Provident

- FinCEN Underestimates Time Required to File Suspicious Activity Report

- Retirement Planning Creates Discord Among Couples

- Wall Street Looks at Big Bank Earnings, but Regional Banks Tell the Story