Quick lesson in loan swaps

Derivatives help in individual credits, as well as view of pricing

- |

- Written by ALCO Beat

ALCO Beat articles featured exclusively on bankingexchange.com are written by the asset-liability management experts at Darling Consulting Group.

ALCO Beat articles featured exclusively on bankingexchange.com are written by the asset-liability management experts at Darling Consulting Group.

By Jeffrey Reynolds, managing director, Darling Consulting Group

For years, community banks have utilized derivatives to hedge interest rate risks.

Pre-FASB 133 (issued in the late 1990s), layering on an interest rate cap/swap/floor to hedge macro balance sheet interest rate risk was a fairly easy proposition—at least in terms of understanding and explaining. Caps and floors worked as insurance policies against rate movements in a certain direction, and swaps were an exchange of cashflow streams from fixed to variable (or vice versa).

The need to have accounting statements reflect off-balance sheet exposures on balance sheet brought to light the perils of inconsistencies between accrual accounting (used to calculate income for most financial instruments on a bank’s balance sheet) and the fair value approach (used to account for derivatives).

While enough has been written about hedge accounting to fill an “old school” encyclopedia set (BG—“Before Google”), the long and short of it is that accounting rules have made the subject of derivatives that much tougher to explain and to garner support for by community-sized bank management teams and boards.

That’s too bad, because they could be helping more banks and bank customers now, even on the threshold of rate increases, when the Federal Reserve moves forward with them.

Why loan swaps?

Indeed, despite potential accounting complexities, loan hedging via the use of interest rate swaps continues to draw interest from community banks. Attend any banking conference and odds are you will hear how some banks use interest rate swaps to “unlock demand” in their markets. Given the current scarcity of quality credits and uncertain interest rate conditions, loan swaps are receiving a renewed interest.

Do banks really use them with success? Do customers really see swaps as a benefit? In fact, some do. Still, many investigate the technique but walk away thinking, “This swap business is just not us,” or “Our customers will never go for it.”

Culture and customer desires are important and valid factors. However, one really has to understand the swap market and the power of the swap curve for pricing even if you have a sign on your front door that states “No Solicitors or Derivatives.”

Failure to do so can lead to passing on some fairly priced deals because the loan committee feels they are priced too thinly. It may also limit your bank’s view of what competitors using swap programs in the market are doing from a structural standpoint—rendering your approach to selling loan offerings ineffective.

CliffsNotes on loan swaps

The easiest way to understand a swap is as an agreement to exchange a variable rate cashflow stream for a fixed-rate cashflow stream or vice-versa.

Banks that want to stay short on asset duration would love to book variable rate loans—but they would quickly find cobwebs on their phones if refusing to lend at fixed rates. Customers usually want fixed, and why not? Most banks offer fixed-rate loans without prepayment penalties or with weak penalties that essentially shift all of the interest rate risk onto the bank.

Loan swaps can fix this of course, where everybody gets what they want by using a third party to assume the bank’s rising rate risk associated with fixing the rate on a loan.

This seems to unlock countless doors to knock on and roll out fixed-rate options that surely will be appealing to loan customers.

No cure-all for tight credit spreads

There are some things that swaps cannot do. One example: Swaps can’t enhance a tight credit spread. Think of this as an algebraic equation that can be solved from one side or the other, given that you have one or two of the variables in hand:

Fixed Rate on Loan Negotiated with the Customer = Fixed Swap Rate + Credit Spread of Loan

For example: A bank recently told me they were looking at a fixed-rate commercial real estate deal with a 5-year balloon and 25-year amortization at 3.75%. A LIBOR swap with the same term structure has a fixed rate of 1.55%. Solving algebraically for the credit spread reveals a credit spread of 2.20%.

The floating rate the bank would retain by swapping out the rising rate risk of the fixed-rate component of the loan would be 1-month LIBOR (currently 0.18%) + 2.20%. That’s right: a 100% risk-weighted floating-rate asset that is going to earn a whopping 2.38% in the current rate environment.

Banks often look at the end yield and say, “I can’t live with that” and put the fixed rate of 3.75% on their books for five years. In this case, whether intended or not, the bank has elected to take on interest rate risk to subsidize a tight credit spread.

“But I do Prime lending, not LIBOR”

That’s a common retort, but it does not matter. What matters is the fixed rate you can negotiate with your loan customer. Pricing on the same-termed swap is available using WSJ Prime as the index instead of 1-month LIBOR. That rate is 4.55%. Fixed Loan Rate of 3.75% = 4.55% Fixed Swap Rate–0.80% Credit Spread. Floating rate asset left after interest rate risk is removed is Prime at 3.25%–0.80% = 2.45%.

A common response from a banker is, “We don’t lend at Prime–0.80%.” Guess what? If you lend fixed in the 3.75% range on a 5/25 structure―you actually do.

You can also see the end result of changing the index does not matter all that much. The reason LIBOR is the preferred index over Prime is the LIBOR swap market is significantly larger, more liquid, and easier to execute on. But the economics of being fixed versus variable are the same.

“My customers won’t accept a prepayment penalty”

This is the case with many community bank loan customers. A step- down prepayment structure of 3%/2%/1% is often what community banks receive for assuming fixed-rate loan risk. Here is the rub with swaps, however: Loan customers have to assume the interest rate risk in the form of a full market prepayment penalty if interest rates do not rise. Conversely, if rates go up, the customer also can potentially book a gain on the swap.

Knowing that the last time the Federal Reserve raised rates was in mid-2006, loan customers who utilized swaps since then likely have found they have market value losses in the instruments that have prevented them from refinancing as market rates have come down and credit spreads have tightened. As these stories circulate through Rotary Clubs and Chambers of Commerce meetings, swaps tend to get a bad name.

Value of the curve

Many banks can easily justify holding fixed-rate loans if the term is less than five years, and thus discount the value of a loan swap program.

But what if the market starts to demand 10-year fixed—which I have been hearing about from some clients? What is your comfort level with that term if you were already feeling like you were stretching going out five years?

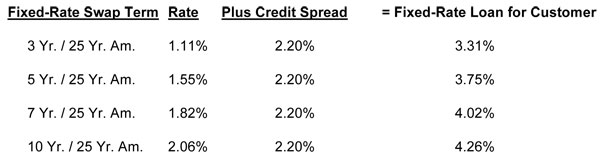

While swap programs may not be for you, they most certainly are in the arsenal of many banks and, therefore, are something all lenders should understand. The way swap-based lenders tend to work on the algebraic equation is a little different. They start with the floating rate spread they will accept on a credit (which we will keep at LIBOR + 2.10% for this example). They then present options for fixing the loan based on the swap curve.

Consider the following being placed in front of a loan customer:

Top management of the bank issuing the loan has already determined it is willing to accept a floating rate of 1-month LIBOR + 2.20%. The customer has already bought into the notion of using a swap and is now free to pick their term: 10 years at 4.26% looks pretty enticing to many. And truth be told, that 2.20% credit spread is not that thin for true “A” credits with decent size bank relationships. I have seen banks compete along the LIBOR 1.50% spectrum in recent times. Imagine sub 4% for 10 years!

Looking forward

If your bank is not using swaps, it needs to at least be conversant in them and understand the mechanics. Competitors use them and can set market expectations on rate and structure, often presenting challenges for more traditional fixed-rate lenders.

Further, the swap market helps establish a “pricing for risk” concept that some banks lack. Knowing what you are truly being paid for credit via the swap examples outlined above can help facilitate great discussion at ALCO and credit committee meetings, regardless of whether your bank offers a swap program or not.

About the author

Jeff Reynolds is a managing director at Darling Consulting Group. After serving as an auditor in the insurance and banking industries, Jeff joined DCG in 1996. His analytical and managerial skills led him on a career path within DCG that culminated in his current role as Managing Director. In this capacity, Jeff’s primary responsibility is advising clients on ways to enhance earnings while more effectively managing their risk positions. He regularly assists clients with strategic and capital planning projects and has also served on numerous due diligence teams for client acquisitions. Jeff is a frequent author and speaker on a variety of balance sheet management topics and has served as a guest faculty member for the ABA’s Stonier Graduate School of Banking.

Tagged under ALCO, Management, Risk Management, HowTo, Rate Risk, ALCO Beat, Feature, Feature3,