Branches holding own

Omnichannel, not multichannel, becomes key

- |

- Written by Website Staff

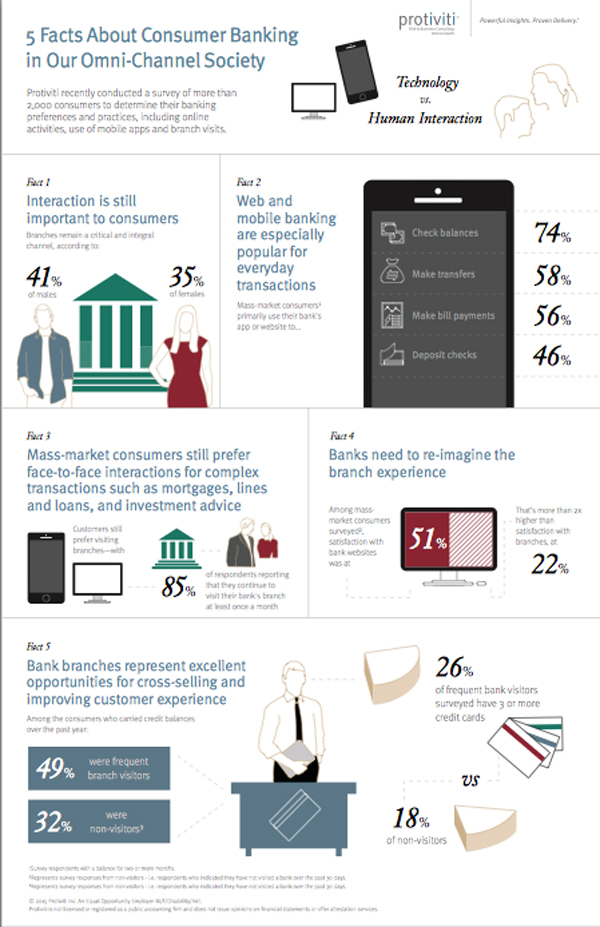

Despite today’s focus on both online and mobile banking, bank customers still seek human interaction at local branches, according to Protiviti’s 2015 Consumer Banking and Payments Survey.

The survey found that 84% of bank customers still visit their branches at least once a month.

“It wasn’t long ago that bankers were scratching their heads over the number of customers coming into the branch asking about online banking,” says Jason Goldberg, a director in Protiviti’s business performance improvement practice. “Our survey suggests that in the mind of the customer, the branch continues to be the place where their money ‘lives,’ while the web and mobile are applications that direct the movement of that money.”

Clearly, Goldberg continues, consumers seek an omnichannel experience, where they move within and between channels for product purchases and account servicing and management.”

Protiviti surveyed more than 2,000 consumers aged 20 through 69 in the United States to identify the perceptual and behavioral trends in banking practices, including service delivery preferences, online banking, credit card security, and the adoption of new payment products.

A steady shift from multichannel—offering banking options from which customers could choose one—to omnichannel experiences—in which customers can fluidly move across multiple options—continues to be apparent as customers take advantage of multiple banking options (e.g. websites, mobile, ATM, branches, etc.).

In fact, the survey identifies no negative correlation between the frequency of bank visits and web and mobile banking use.

Branch users appear happier

Of the individuals expressing a channel preference, frequent branch visitors were more effusive in their praise of their brick-and-mortar locations (53%) than nonvisitors were about their mobile (33%) experiences. Such consumer preference represents an excellent opportunity for cross-selling and improving the customer experience, Protiviti says.

The study found that younger millennials (under age 30) are using mobile applications most frequently, a finding that holds up across various types of transactions from checking balances (approximately 83%), to sending money (approximately 46%). Millennials are also more likely to use their phones to make a variety of smartphone purchases such as merchandise, media, and groceries. Not surprisingly, in-store and online purchases using smartphones decline with age.

Also on the minds of many consumers and retailers is the new EMV transition. According to those surveyed, 70% feeling that using chip security versus a magnetic stripe will be more secure, while just 4% feel it will be less secure.

Tagged under Retail Banking, Channels,