Make small consumer loans, OCC urges

New bulletin meant to send signal of agency acceptance

- |

- Written by Steve Cocheo

National banks should get back into smaller consumer installment loans, and can confidently proceed knowing the Comptroller's Office approves of the concept, according to policy document issued this week.

National banks should get back into smaller consumer installment loans, and can confidently proceed knowing the Comptroller's Office approves of the concept, according to policy document issued this week.

The Comptroller’s Office has sent national banks a message that it won’t oppose—and actually will encourage—programs to reenter the small consumer installment loan business.

On May 23, OCC issued Bulletin 2018-14, “Core Lending Principles For Short-Term, Small-Dollar Installment Lending,” in conjunction with a press briefing featuring both Comptroller of the Currency Joseph Otting and Deputy Comptroller for Credit Risk Richard Taft.

In a sense this move was OCC dropping the other shoe after it rescinded its Bulletin 2013-40, “Deposit Advance Products: Final Supervisory Guidelines” last October during the term of Acting Comptroller Keith Noreika.

At the beginning of the press meeting, Comptroller Otting noted that he’d taken office last November with three key goals: Community Reinvestment Act regulatory reform; rationalizing anti-money laundering regulation in concert with the Financial Crimes Enforcement Network; and making banks comfortable again with engaging in small-ticket consumer lending.

Otting has maintained that 2013-40 and related steps discouraged national banks from offering consumer installment loans of $300 to $5,000. During the briefing he pointed out that estimates say that the need for such short-term, small-dollar loans is around $90 billion annually, frequently for consumers’ emergency needs, ranging from the purchase of tools to begin a new job to auto repair.

Improving financial inclusion

“Often people are frozen out of the ability to do that,” Otting told reporters, “due to historical job patterns or credit-related issues.” Otting believes consumers should have more choice in this area and that banks should be a greater part of that choice.

“Helping people get back into mainstream banking and get off of high-cost financial services like check cashing and payday lending” is the intent behind OCC’s actions, he said. He said estimates are that 25-50 million consumers would benefit if banks returned to short-term, small-dollar lending.

Officials stressed that banks would still be expected to offer such credit in a safe and sound manner and the bulletin itself urges institutions to discuss new programs with examiners or other OCC officials prior to launching them. Programs are also expected to be fair to consumers and subject to risk management principles.

The new OCC bulletin is not a new regulation or rule—officials didn’t feel one was needed, only a sign that the agency approved of the activity under existing standards. Otting said this was a restatement and clarification of national bank rules, and confirmation that making consumer loans to borrowers with higher debt-to-income ratios and lower credit scores than are typical today were acceptable to OCC.

Otting said that a frequent complaint he’s heard since taking office was that national banks were not providing credit to consumers with FICO scores of below 680. (That score is considered to be towards the low end of the “good” range for FICOs, according to Experian’s website calculator. The best scores are over 800.)

Otting said he had spoken with many top national bank officials about this issue. “A lot of banks wanted to hear from us that we were supportive of them entering the market and doing it below traditional standards,” he said. “This is the signal they’ve been looking for.”

In a recent roundup of sources for short-term consumer loans, Nerdwallet noted that three of the top five banks don’t offer personal loans anymore and that marketplace lenders were among the sources that have filled the gap. In his remarks Otting acknowledged that the need didn’t go away even though banks had substantially left the unsecured personal loan business.

Payday lending still under bureau’s eye

The bulletin covers loans of greater than 45 days. OCC has been in discussions with the Bureau of Consumer Financial Protection concerning loans of shorter duration. The bureau, transitioning from its Consumer Financial Protection Bureau name at Acting Director Mick Mulvaney’s order, is reconsidering the payday lending rule that it issued earlier, which applies to the shortest-term consumer credit. The Pew Charitable Trusts estimates that American consumers spend more than $30 billion annually to borrow through such programs and that approximately 100 million payday loans are extended annually.

Otting told reporters that he favors banks entering competition with payday lenders and similar creditors, to “make new products available” to borrowers currently relying on such measures. A recent study by TransUnion found that some customers currently using such alternative lending services could actually be decent customers for traditional consumer installment credit. [Read “Alternative loan borrowers may be traditional prospects”]

“There’s a large market of needs that are not being served,” added Otting.

What should new programs look like?

OCC officials suggested that some banks were already developing new offerings in anticipation of the week’s announcement, and that some banks already offer such credit. When asked by a reporter who the latter were and what they were offering, officials declined to give any details.

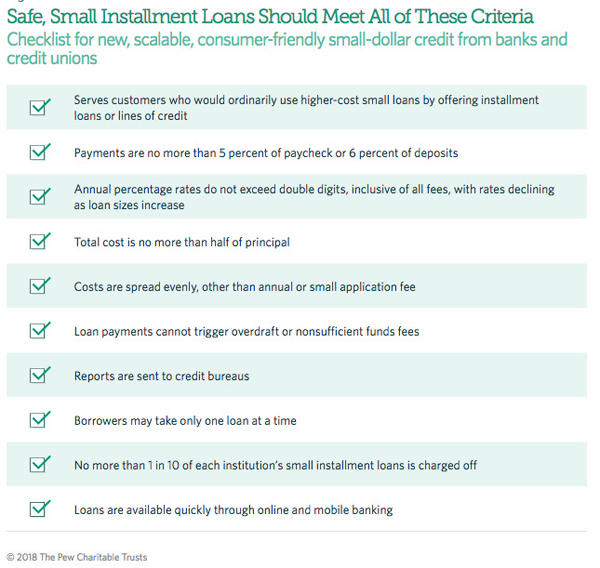

In a February 2018 report, Standards Needed For Safe Small Installment Loans From Banks, Credit Unions, the Pew Charitable Trusts stated:

“The opportunity for more banks and credit unions to enter the small installment loan market is not without its challenges. In order for these traditional lending institutions to seriously compete with the large number of payday and other nonbank small-dollar lenders that market aggressively, many banks and credit unions—especially large ones—would need not only to offer small-dollar loans but to make sure that consumers are aware that they offer such loans. And banks and credit unions would need to compete with nonbank lenders on speed, likelihood of approval, and ease of application, because small-dollar loan borrower usually seek credit when they are in financial distress.”

The Pew report mentions several institutions whose small-dollar programs Pew recommendations.

Recommendations from the Pew Charitable Trusts’ report on small-dollar lending.

Reaction from bank groups, consumerists

The OCC announcement came in a banner week for banking news, ranging from President Trump’s signing of major new banking legislation to Senate approval of the nomination of Jelena McWilliams as the new FDIC Chairman, completing the appointments of Trump leaders to the three prudential bank regulators.

Banking groups’ official reactions seemed somewhat restrained in tone.

“ABA welcomes Comptroller Otting’s leadership in recognizing that banks have an important role to play in serving consumers’ small-dollar credit needs,” the American Bankers Association said. “There is a clear demand for small-dollar loans, and today’s bulletin is a step in the right direction to help banks offer customers a variety of short-term credit products.”

ABA added that it appreciated the apparent flexibility in the principles issued.

“Community banks pride themselves on having close relationships with their customers and being able to provide an affordable product that accommodates their short-term financial needs,” said the Independent Community Bankers of America. “The OCC’s guidance acknowledges the value of small-dollar lending.”

The Consumer Federation of America called OCC’s policy statement “ambiguous.”

Christopher Peterson, CFA financial services director, said the guidance “includes some laudable consumer protection principles, but the devil will be in the details. If the OCC does not back up this policy with an aggressive supervision and enforcement program, some greedy banks will try to develop abusive products.”

Among CFA’s concerns was that OCC’s document includes no explicit limits on interest rates or fees.

The Pew Charitable Trusts welcomed OCC’s announcement.

“Numerous banks have expressed interest in offering small installment loans, and the OCC’s action removes much of the regulatory uncertainty that has prevents them from entering the market,” said the organization.

The Pew Trust continued, pointing out that its own research indicates “that by using automated underwriting and origination to keep their costs low, banks and credit unions can offer small-dollar credit profitably at prices six times lower than average payday loans. Pew’s recommended criteria would enable the necessary automation while providing strong consumer protections.” [Editor’s note: See table earlier in this report]

Tagged under Consumer Credit, Management, Financial Trends, Retail Banking, Risk Management, Customers, Credit Risk, Feature, Feature3,

Related items

- Banking Exchange Hosts Expert on Lending Regulatory Compliance

- Merger & Acquisition Round Up: MidFirst Bank, Provident

- FinCEN Underestimates Time Required to File Suspicious Activity Report

- Retirement Planning Creates Discord Among Couples

- Wall Street Looks at Big Bank Earnings, but Regional Banks Tell the Story