Tax reform impacts superregional results

U.S. superregional banks had noisy Q4'17 due to new law

- |

- Written by S&P Global Market Intelligence

S&P Global Market Intelligence, formerly S&P Capital IQ and SNL, is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the SNL subscriber side of S&P Global's website.

S&P Global Market Intelligence, formerly S&P Capital IQ and SNL, is the premier provider of breaking news, financial data, and expert analysis on business sectors critical to the global economy. This article originally appeared on the SNL subscriber side of S&P Global's website.

By Joshua Recamara and Robert Clark, S&P Global Market Intelligence staff writers

The bottom-line results for U.S. superregionals—select banks with $50 billion to $500 billion in total assets—was noisy in the fourth quarter of 2017 because of recently enacted U.S. tax reform.

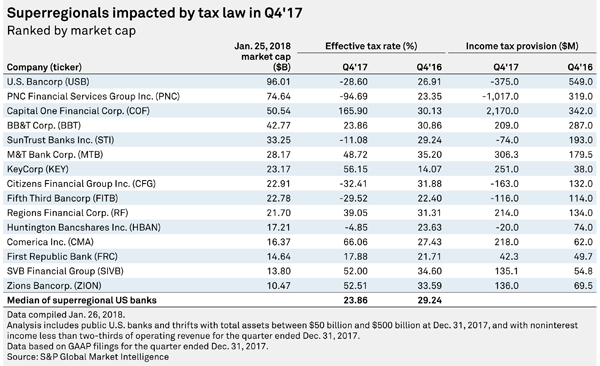

The group's median effective tax rate for the quarter dropped to 23.86% from 29.24% a year ago. Of the 15 superregionals, eight reported a lower year-over-year income tax provision, and six of the provisions were negative.

PNC Financial Services Group Inc.'s provision for the recent quarter was negative $1.02 billion, compared to $319.0 million in the year-ago period. Aside from taxes, Piper Jaffray analyst Kevin Barker noted positive trends in the company's loan growth, particularly on the consumer side.

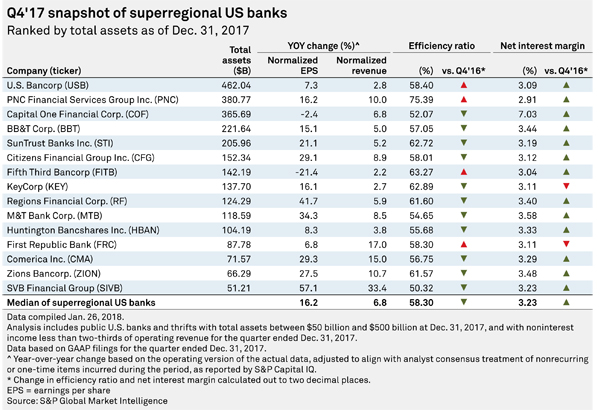

Gross loans also continued to grow at SVB Financial Group, up 16.1% in 2017, driven by increases in its private equity and venture capital segment. The loan growth, combined with margin expansion and higher noninterest income, propelled the company to 57.1% normalized EPS growth for the quarter, on a year-over-year basis, topping all superregionals. The group's median earnings growth rate was 16.2%, while median normalized revenue growth was 6.8%.

Just two of the superregionals, KeyCorp and First Republic Bank, booked a lower year-over-year net interest margin. The quarter-over-quarter comparison was a different story, however, skewed by tax reform. Only six of the 15 companies experienced margin expansion relative to the third quarter of 2017.

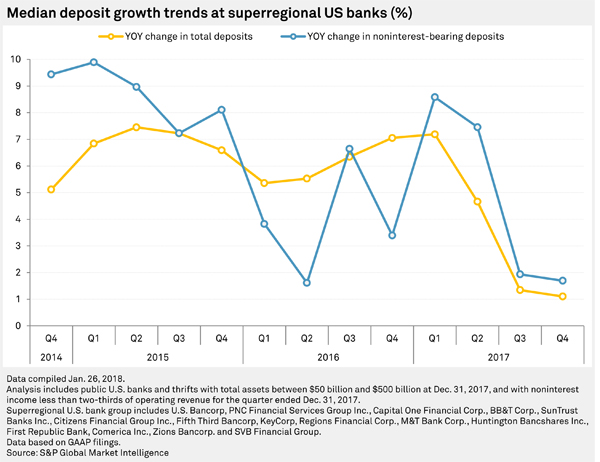

Meanwhile, year-over-year total deposit growth continued to decline, falling to 1.1% from 1.3% in the prior quarter and 7.1% in the fourth quarter of 2016. Even with rising rates, superregionals managed to increase noninterest-bearing deposits at a faster pace than total deposits for the fourth consecutive quarter. BB&T Corp. was the most extreme example, boosting noninterest-bearing deposits by 6.1% when total deposits were down 1.8%.

In 2018, Barker expects the market to change its focus to the impact of additional rate increases instead of taxes. He projects deposit betas to accelerate broadly this year.

This article originally appeared on S&P Global Market Intelligence’s website on Feb. 5, 2018, under the title, "US superregional banks had noisy Q4'17 due to tax reform"

Tagged under Management, Financial Trends,