Amazon, Google, PayPal tops for millennials

Survey indicates comfort with many nonbanks for financial services—and a twist

- |

- Written by Steve Cocheo

Is it possible that in the not too distant future, “Amazon Prime” won’t be just a multi-faceted “membership”-style buying and streaming service, but also an interest rate?

Amazon doesn’t own a retail bank today, nor operate anything quite like one yet, beyond a credit card, but it leads a listing, below, of non-traditional providers that recent research indicates that millennials would be willing to do financial business with.

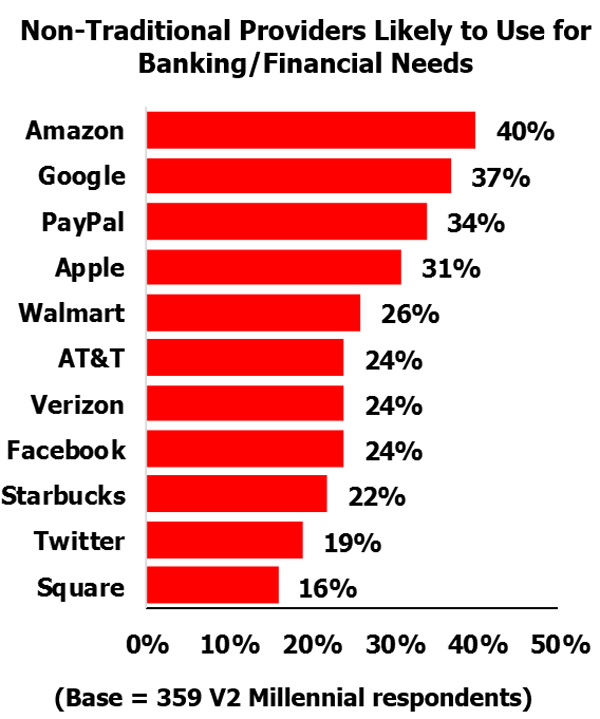

A study based on internet interviews by Synergistics Research, Millennials: Financial Insights, asked which nontraditional providers the millennials might tap for banking and financial needs.

Leading the list were Amazon (40%) and Google (37%), followed by PayPal (34%) and Apple(31%). Current financial experience with most of the companies mentioned is limited, but the willingness is there.

Two-thirds of the sample do have PayPal accounts, indicating that being tied into a company doesn’t necessarily mean you’ll use their service.

Interestingly, Square, which features a special gadget that allows card swipes to be entered into a smart device, ranked lowest among the companies listed by Synergistics.

Threat … and opportunity

“Millennials are not necessarily wed to the traditional banking and financial system,” says Genie Driskill, COO at the research firm. “Millennials are not going to abandon traditional financial providers; however, they will look at all types of organizations including nontraditional providers to meet their financial needs.”

While the survey shows a level of comfort with technology and social channels, Driskill says Synergistics research indicates there is more to millennials and finance than tech-oriented providers and the latest apps.

“Millennials have a thirst for financial information and advice,” Driskill says in an interview with Banking Exchange. “They consider banks an important source of advice. But banks can’t put their messages in the same-old same-old way. You can’t just put up a chart with numbers anymore.”

As an example of the kind of approach millennials would like, Driskill pointed to the PNC Virtual Wallet. More than 2 million people use some version of this PNC product now.

Tagged under Retail Banking, Customers, Feature, Feature3,