SNL Report: Banks join tax-worried dividend parade

SNL Report: Post-election, special dividend declaration nearly triple

- |

- Written by SNL Financial

By Jack Chen and Maria Tor, SNL Financial staff writers

Not pennies from Heaven, but dollars from the boardroom: For an unusually large number of banks' shareholders, this is a time for a smile to be their umbrella.

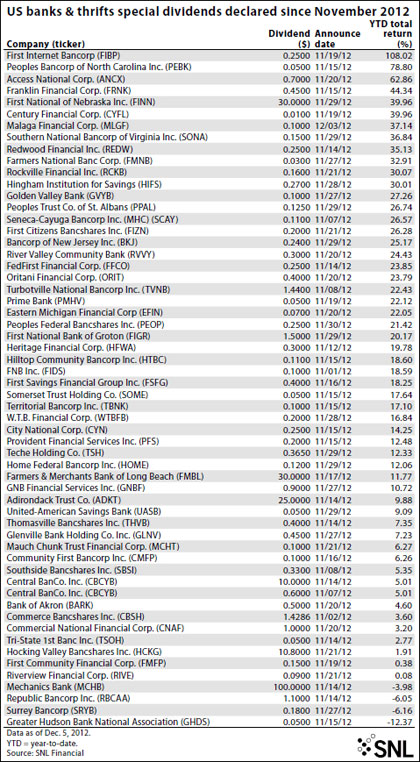

In the wake of a flood of special dividends declared in advance of possible 2013 tax hikes, SNL Financial compiled a list of banks and thrifts that have declared special dividends since the re-election of President Barack Obama.

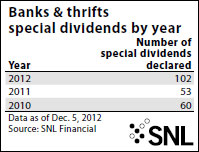

Fifty-seven banks and thrifts have declared special dividends from Nov. 1 through Dec. 5. This compares to just 19 banks and thrifts that declared dividends during the same time period in 2011.

|

||

| For a large version, click on image or click here. |

The wave of special dividends crosses all industries in the U.S. Companies are accelerating payouts due to the possibility that dividend taxes may increase in 2013.

Notably, the increased dividends are limited to smaller banks that aren't subject to the Federal Reserve's stress tests under the regulator's Comprehensive Capital Analysis and Review. Banks subject to the CCAR need the Fed's permission to disburse capital to shareholders.

For a large version, click on image or click here.

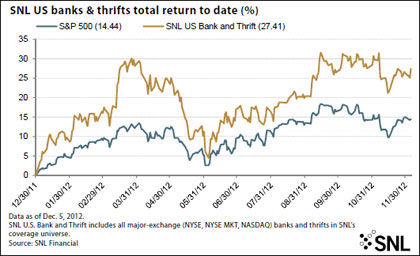

Since the Nov. 6 election, the SNL U.S. Bank and Thrift index has lost 3.09% through Dec. 5, compared to a loss of 1.04% in the S&P 500 over the same period. Year-to-date, however, the SNL U.S. Bank and Thrift Index has returned over 27%.

For a large version, click on image or click here.

Tagged under Financial Trends,