Attracting and retaining (and paying for) a qualified board

Part 4 of a series: How boardroom comp's evolving—or not

- |

- Written by Crowe Horwath Compensation Study

As financial institutions continue their recovery from the recession, executives, and managers—especially those in the most critical positions—have begun to see modest but steady gains in salary, bonuses, and incentives. For bank directors, however, the picture is not as clear.

Every year Crowe Horwath LLP surveys financial institutions throughout the U.S. about various salary, incentive, and benefits issues, including compensation for members of their boards of directors. This article, the fourth in a series exploring the 2013 Crowe Horwath LLP Financial Institutions Compensation and Benefits Survey, examines how average director compensation has registered only uneven and intermittent gains over the past four years, despite growing board workloads and responsibility.

Overall picture: inconsistent trends

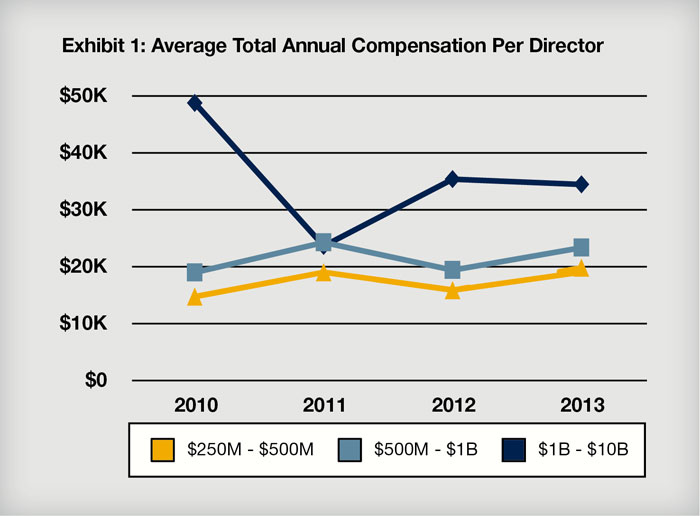

As is the case in every industry, compensation for bank directors varies significantly according to the size of the institution. As Exhibit 1 shows, the 2013 survey found that the average total annual compensation for a director of a large bank ($1 billion to $10 billion in assets) is $34,544. That figure is about 48% higher than the average for banks with $500 million to $1 billion in assets, and it is about 74% higher than the average for small banks ($250 million to $500 million).

While variance according to institution size is not unexpected, the inconsistent trends over time are surprising. Although directors of smaller banks have seen a general upward trend over the past four years of recovery, compensation trends for directors in medium- and large-size banks have been decidedly uneven. Large banks, in particular, reported a sharp drop in director compensation in 2011, bouncing back in 2012, and leveling off in 2013.

These sporadic trends could be due in part to changes in the survey population from one year to the next. In addition, the representation of certain geographic regions in the survey varied somewhat from year to year. Nevertheless, despite these anomalies, there clearly is no general consensus across the industry regarding how to handle the always delicate question of board compensation.

Changes in board workloads and operations

The lack of a clear trend in overall board compensation levels reflects a similar inconsistency in the time demands banks impose on their directors. For example, when asked about their institutions’ meeting schedules and practices, survey respondents indicated the number of full board meetings has not varied significantly over the past four years.

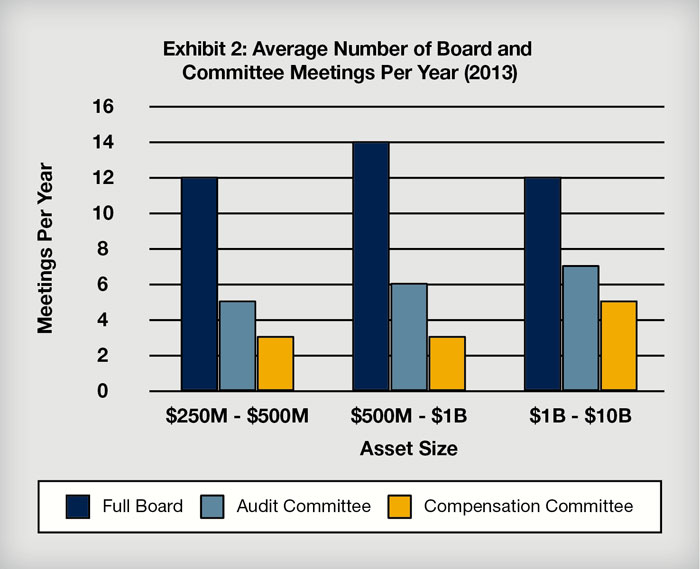

Once again, though, notable differences can be seen when the responses are grouped by institution size. While monthly board meetings are generally the norm in banks of all sizes, the frequency of audit committee and compensation committee meetings increases noticeably in larger banks (Exhibit 2).

On average, compensation committees typically meet three times a year in small- and medium-sized banks but five times a year in banks with more than $1 billion in assets. An even clearer trend can be seen in audit committee meetings, which typically are held five times a year in smaller institutions, six times a year in medium-sized banks, and seven times a year in banks with more than $1 billion in assets.

In addition to reflecting large banks’ more complex compliance and compensation issues, these results might also suggest that the boards of larger banks are more likely to delegate many of these issues to designated committees, while smaller institutions’ boards are more likely to take a more direct, hands-on approach.

It is important to note, however, that the survey tracks only the number of meetings, not the amount of time the meetings consume. Anecdotal accounts indicate that most directors believe committee meetings are longer than they used to be and require significantly more advanced planning and preparation.

Changes in board compensation practices

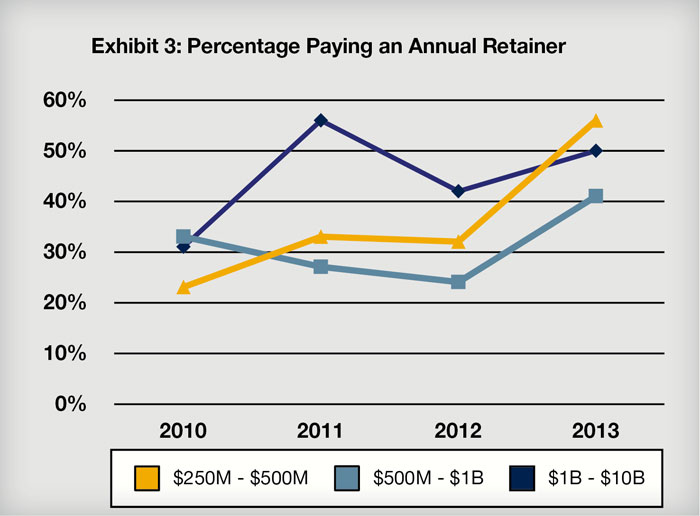

Unlike the inconsistent trends regarding total compensation, very distinct patterns can be seen in the way director compensation is determined. There has been a significant increase over the past four years in the number of institutions that pay their directors an annual retainer, either instead of or in addition to meeting fees. While the trend slowed slightly in 2012, the 2013 survey showed another sharp increase (Exhibit 3).

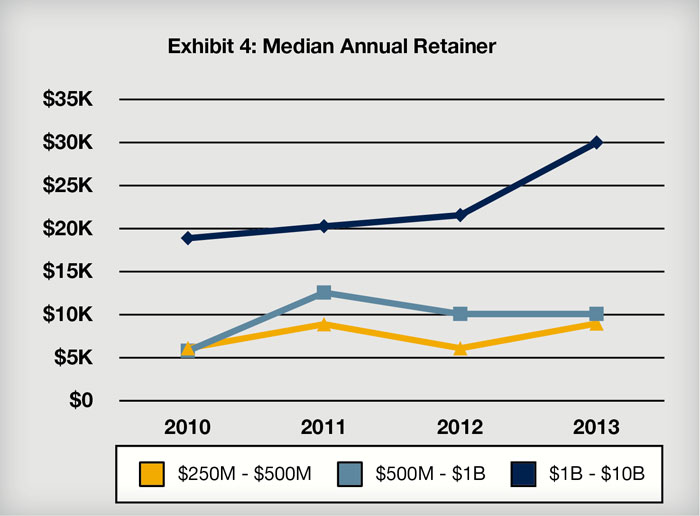

On the other hand, the average size of the retainer shows a less clear-cut picture. According to the survey, the median annual retainer paid to board members has remained fairly stable in small- and medium-sized banks over the past four years, while retainers in large banks jumped substantially in 2013 (Exhibit 4).

Comparing these mixed retainer trends to the overall board compensation trends cited earlier, the picture that emerges is that of an industry that is adjusting to changing demands on its directors and changing expectations of the roles directors should play in institutional governance. More and more financial institutions are seeking board members with specific skills and experiences, including accounting and risk management expertise. Even in small institutions, recruiting and retaining such individuals often requires more than merely the prestige and networking opportunities that once were sufficient to attract board members.

Time for a Raise?

Despite the increase in the use of retainers, the overall compensation paid to directors of financial institutions continues to lag significantly behind the compensation paid to their counterparts in technology, manufacturing, and retail businesses. For example, the $34,544 average total director compensation that the survey found among large institutions is only a fraction of the average compensation paid by companies of comparable size in other industries, where six-figure directors’ fees are not unusual.

Moreover, the inconsistent gains in director compensation occurred in spite of steady growth in directors’ workloads and responsibilities, particularly in the areas of regulatory compliance and risk management. Other issues that boards address, such as investor relations and strategic planning, also have grown more complex in recent years. New trends such as social media and mobile banking technology mean directors must also familiarize themselves with new types of technology that will affect how they formulate and implement policies.

Finally, the important board responsibility of succession planning and leadership transition also has taken on new urgency. Having steered their banks through the depths of the recession, a growing number of senior executives feel now is a logical time to consider retirement. As their replacements are promoted from within, gaps in the next levels of upper management often become apparent.

The next article in this series will examine the larger question of workforce and management development, focusing on the human capital metrics that financial institutions are using to gain insight into their workforce needs.

Editor’s Note: Bankers will also want to check out ABA’s Compensation and Benefits Survey. Read a summary from Banking Exchange’s “Bank Notes” section here. Contact Mike Mazur, senior manager, ABA Benchmarking Survey Research Group.

Tagged under Management, Human Resources, CSuite, Feature,

Related items

- Ray Dalio and Jamie Dimon Interviews Beg the Question: Where Is the Party for Fiscal Deficit Issues?

- Mortgage Rates Drop to Two-Month Lows

- Industry Leader Believes the Promise of AI Is Worth the Pursuit

- Agencies Issue 2025 Regulation CC Cost of Living Adjustments

- Banking Groups Challenge SEC Regulation