After acquisition, it’s all about customers

What you don’t know about customer behaviors can hurt you

- |

- Written by Paul Schaus

If customers picked up through M&A don't feel like they are in good hands, they'll walk, sooner or later.

If customers picked up through M&A don't feel like they are in good hands, they'll walk, sooner or later.

Bank executives contemplating a merger or acquisition must evaluate a variety of factors before deciding to move forward with the deal. But what is often left out of the decision-making process is the impact on customers.

How will the merger or acquisition affect relationships with customers? How can the combined organizations do a better job of retaining customers and building loyalty by reassuring them during the merger and acquisition process?

Too often, customer impact is an afterthought—even though without customers, there’s no business.

How vulnerable are your customers?

Customers are three times more likely to leave a bank during the merger and acquisition process than at other points, according to a study by J.D. Power and Associates.

Indeed, banks expect—and plan for—some customer attrition during a merger and acquisition. The number of customers who close accounts are easy to measure.

But what we don’t know is the impact on the behaviors of those customers who stay with the bank after an acquisition. Are they still committed to the bank as their primary institution? Or are they looking to move portions of their business to another financial—or non-financial—institution?

To uncover how customers really feel about their bank being acquired and how those feelings drive their behaviors, CCG Catalyst Project Catalyst, surveyed 100 customers of 35 recently acquired U.S. banks. [Access our survey and report, Banks Acquired: Actions and Concerns of Customers]

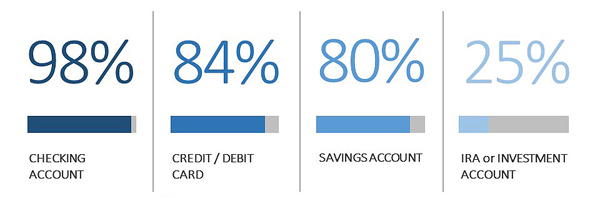

These customers were well entrenched in their current banking relationship. The majority of customers surveyed (98%) had a checking account with the bank, 80% had a savings account, 84% had a credit and/or debit card, and 25% had an IRA or investment account with the bank.

Not surprisingly, their interactions with their institution were mainly through non-branch channels. Only 25% of these customers frequently visit a branch and 10% had a relationship with a personal banker or officer.

Few customers happy about acquisition

We found that only one in four customers had a positive reaction to their bank’s acquisition. About three-quarters of customers (46%) said they had neutral or negative (26%) feelings about the acquisition. Those negative emotions included fear (10%), sadness (10%), and disgust (6%).

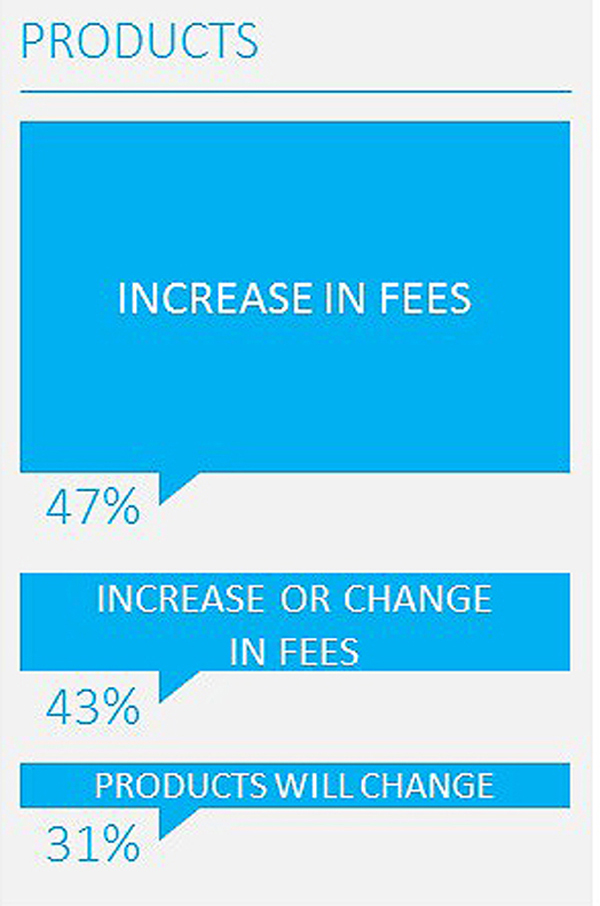

What upset customers most was the potential for higher costs and less service. When asked to relay their top concerns about the acquisition, customers worried about fee increases (47%), customer service deterioration (33%), job losses for branch employees (28%), and branch closings (25%).

If they feel like a “faceless number,” customers will be more likely to leave the bank, or to keep their current account but open another account at a different institution.

Several customers noted that they did not find out about the acquisition until they drove by the bank branch and saw new signage!

That doesn’t exactly inspire positive feelings.

One survey respondent, who closed her account as a result of her bank being acquired, had this to say:

“Personal customer service will continue to rapidly disappear until it is non-existent. Everyone will become a faceless number … it’s so sad.”

Another expressed frustration about the “constant turnover of new staff that are not allowed to exercise any judgment or common sense. I want a banker who knows me and accommodates my needs and reasonable requests.”

Customers take action

We found that more than one-quarter of surveyed customers took some action as a result of the acquisition. While only 5% closed their accounts with the bank, 22% kept an account at the acquired institution but opened an account with another financial institution.

A bank may consider 5% an acceptable attrition rate, but what the bank is overlooking is that 22% of customers are going elsewhere for financial services as a result of the acquisition, making these customers vulnerable to either eventually leaving the acquired bank or using another bank as their primary financial institution.

The acquired bank may not actually “lose” the customer, but it may have been delegated to secondary status.

Turn potential negative into positive

To turn negative and neutral reactions into positive one, consider potential customer feelings when planning a merger or acquisition.

Remember that customers value banking relationships. For acquired bank customers, the relationship with the newly merged institution can become impersonal, especially if the customer experiences difficulties as a result of the acquisition or if they feel that the bank is not communicating with them.

Acknowledge customer needs when communicating with them about the acquisition. Ensure that there is no disruption to service and that they continue to have easy access to their accounts, information, and funds. Go out of your way to deliver outstanding customer service during the transition.

Communicating throughout the merger and acquisition is critical in keeping customers engaged with the bank and feeling that they matter.

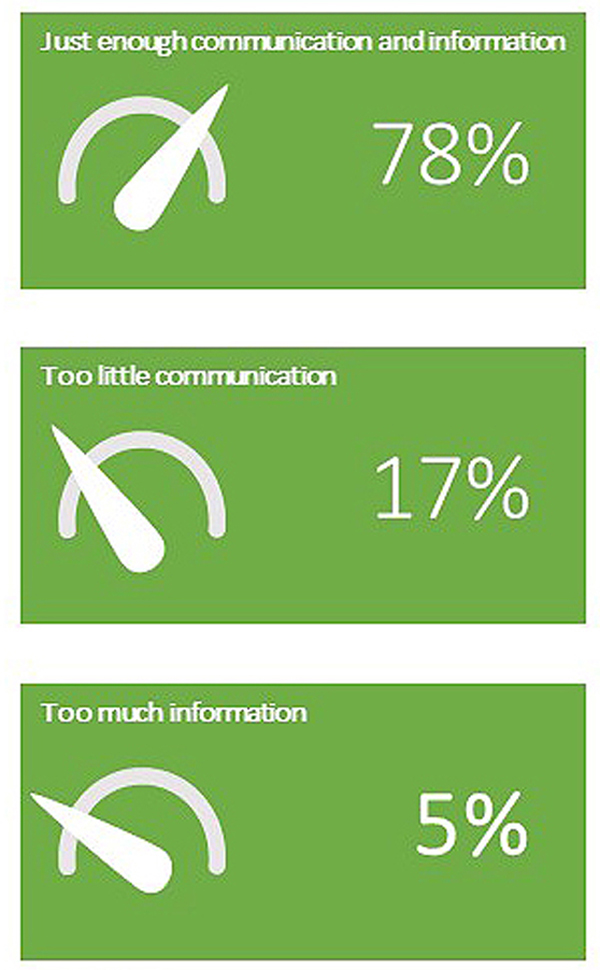

Our take is that it’s better to err on the side of over-communicating. Customers are largely satisfied with the communication they receive from their bank about the acquisition; with 78% saying they received just the right amount. Only 5% said they received too much information, and 17% said they received too little.

Communicate early and often, using notification letters, emails, newspaper articles, and new disclosures.

During communications with customers, be upfront about what they can expect from the merger. Customers’ biggest fears include deterioration of customer service, branch staff job losses, branch closings, and an increase in fees. Address those fears from the start of the acquisition transition.

The key is to build trust from the beginning of the merger and acquisition process to lessen the frustration that customers' experience. For both the acquiring and acquired bank to stay remain relevant for customers, start creating a positive customer experience from the onset.

Tagged under Mergers Acquisitions; CSuite; Big Data; M&A;

Related items

- Spain Blocks BBVA-Sabadell Merger for at Least Three Years

- Bank Merger Activity Stays Steady Despite Early-Year Headwinds

- Thank You to Our Attending Banks

- Banking Exchange Would Like to Thank Its Amazing 2025 Partners for the Banking Exchange National Conference in Chicago June 19

- Abrigo Executive Joining Two Banking Leaders for Discussion on Managing Fraud and Risk June 19th